As Ownership Rate Inches Higher Again, Consumer Actions Trumping Sentiment

Friday, November 3, 2017 by Zelman & Associates

Filed under: homeownership

Several months ago, we wrote an analysis titled “Will This Halt the ‘Renter Nation’ War Cries?” after 2Q17 homeownership rates were published in the Housing Vacancies and Homeownership Survey (HVS) by the Census Bureau. Our analysis pointed to a broad-based increase in the homeownership rate across age, race, region of the country and urbanization.

Earlier this week, the 3Q17 release was not as positive as the prior quarter, but it continued to reflect upward movement in the ownership rate as recessionary effects fade, family formations accelerate, consumer confidence remains strong and new construction targeted at the entry-level buyer gains steam. Specifically, the non-seasonally adjusted ownership rate was 63.9%, up 40 basis points year over year after an 80 basis point increase in 2Q17 and a 10 basis point improvement in 1Q17. Three consecutive quarters of year-over-year expansion has not been witnessed since 1Q05.

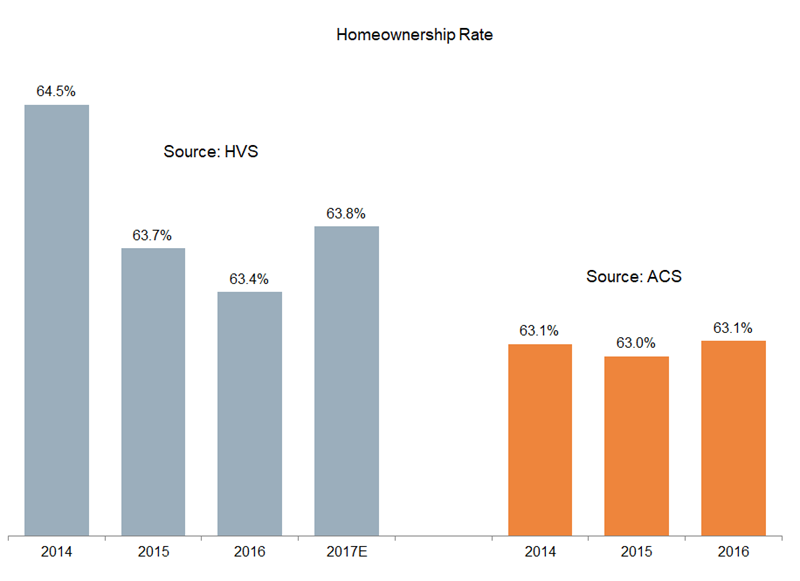

As we have cautioned in the past, over-extrapolating one quarter of Census Bureau data can be a dangerous practice, so we prefer to look at smoothed trends that can more accurately portray the bigger picture. The non-seasonally adjusted homeownership rate has improved 10-20 basis points in the fourth quarter the past two years. If we conservatively assume that 4Q17 holds steady with 3Q17, it would result in a 2017 annual average of 63.8%, which would stand ahead of 2016 (63.4%) and 2015 (63.7%) for this time series, with the increase led by 25-29, 45-49 and 35-39 year olds.

Similarly, the American Community Survey (ACS), also coordinated by the Census Bureau with a sample size 50 times larger than the HVS, just recently published 2016 results. For last year, the homeownership rate was reported at 63.1%, essentially unchanged from 2015 (63.0%) and 2014 (63.1%).

Depending on one’s preferred survey, we would argue that homeownership rates are stable at worst and more likely increasing. Conversely, the media narrative continues to fuel a debate, with a renter survey published by Freddie Mac last week being the latest catalyst, leading to a Wall Street Journal headline of “More People Think Renting is a Better Deal Than Buying”.

The reference is to a question as to whether the respondent believes renting or owning is more affordable. In the latest survey, 76% chose renting, versus 65-68% the prior three editions. The perceived affordability hurdle was present for both multi-family (85%) and single-family (69%) renters. Without getting into the mix and weighting of respondents, which do not appear to be constant throughout time, we note that 56% of these same respondents said that their next move would be into for-sale housing, far in excess of the 24% that deem it most affordable.

Although we do not suggest dismissing the Freddie Mac survey, our experience suggests that sentiment based surveys around homeownership do not typically capture future actions, especially as many factors enter the buy-or-rent decision, stretching far beyond the financial equation.

Friday, November 3, 2017 by Zelman & Associates

Filed under: homeownership

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey