Is Angst About Possible Change to Mortgage Interest and Other Deductions Justified?

Friday, November 17, 2017 by Zelman & Associates

Filed under: homeownershipmacro housing

Over the last two weeks, committees in the House of Representatives and Senate released tax plan proposals that aimed to lower personal and corporate taxes. On the personal side, while the two proposals have many nuances and variances in how tax reductions are achieved, both take aim at tax deductions that are held dear by many households. The extent of deduction usage is driven heavily by the level of income and state of residence, resulting in a disproportionate impact of any changes that could filter through to housing demand.

For background, approximately 70% of tax filers do not elect to itemize their deductions, and instead choose the standard deduction. Thus, with both tax plans proposing to nearly double the standard deduction, these tax filers would be no worse off, and likely better off, with respect to their net tax obligations to the government. Instead, the debate surrounds the 30% of tax filers that itemize their deductions.

Itemized deductions are centered around four key items that account for approximately 80% of the total: (1) state and local income taxes paid at roughly $350 billion; (2) mortgage interest at $280 billion; (3) charitable contributions at $225 billion; and (4) property taxes at $190 billion. Aside from charitable contributions, the other three deductions heavily relate to state and local tax policies and the local cost of living. In other words, households living in states or municipalities with higher income or property tax rates or where the cost of housing is elevated, are more likely to have higher deductible expenses.

For this reason, the share of tax filers itemizing deductions ranges materially at the state level. On the high end are Maryland (46%), Connecticut (41%), New Jersey (41%), Virginia (37%) and Massachusetts (37%). Conversely, West Virginia (17%), South Dakota (17%), North Dakota (19%), Tennessee (20%) and Wyoming (22%) are well below average. As might be expected, there is also disparity by income bracket, with only 19% of tax filers earning $25-50,000 itemizing versus 38% at $50-75,000, 54% at $75-100,000 and 81% at more than $100,000.

We believe that much could change from the current tax proposals before a bill is signed into law, if at all. So at this stage, we offer some initial thoughts as it relates to housing based on concepts that are being debated.

First, we believe that homeownership is principally driven by income and demographics more so than perceived tax advantages, particularly with many homeowners electing the standard deduction. Thus, if sacrificing deductions is accompanied by a higher standard deduction and lower tax rates, it would put more net cash flow in the pockets of households. We believe this would be true for almost all first-time homebuyers, which would be a net positive for overall housing demand and homeownership.

The exception could be in luxury markets within states that have a disproportionate benefit from existing deductions, led by California, New York, New Hampshire, Minnesota and New Jersey, according to our math, as households earning $1 million or more would likely face a reduction in net cash flow in these states.

Second, we believe that conversations about the impact of limiting the mortgage interest deduction (either directly or indirectly through raising the standard deduction) should be in the same conversation as overall tax changes. Too many analyses are treating all else equal, which is not the reality. With that in mind, even if the mortgage interest deduction cap shifts from $1 million of debt to $500,000, we foresee a minor national impact.

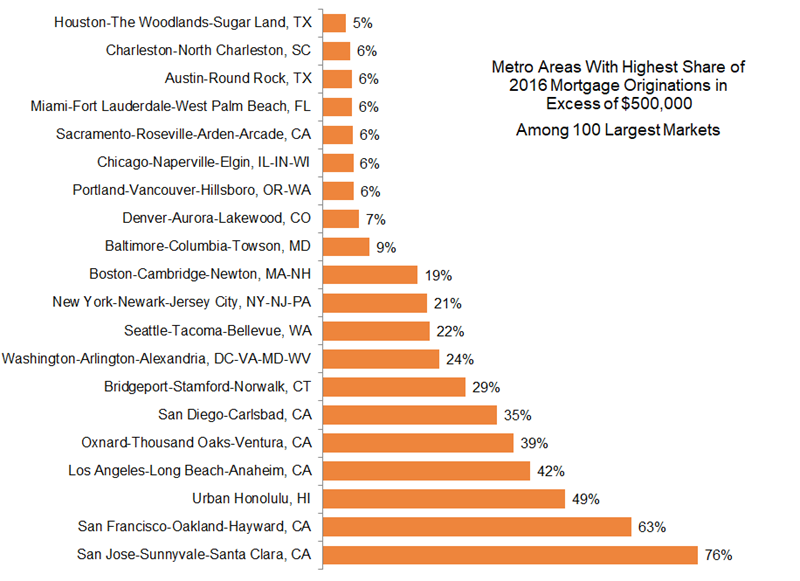

In 2016, only 7% of unit mortgage originations had a balance higher than $500,000, a figure that has ranged from 3-7% over the last 13 years. These mortgages are heavily concentrated, with just 11 metro areas accounting for 65% of the total, centered in coastal California, metro New York-New Jersey-Connecticut, metro Washington D.C. and Honolulu.

As with most policy debates, facts take a back seat to rhetoric and various lobbying groups will likely play a significant role in shaping the final bill. Our initial take at this point is that if final tax cuts resemble the two proposals, there will be a period of confusion as households determine the personal impact. However, once the dust settles, we believe that it would be a net cash flow positive for the vast majority of potential homebuyers, which should further support overall home pricing and demand given the tight inventory backdrop.

Friday, November 17, 2017 by Zelman & Associates

Filed under: homeownershipmacro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey