Cash-Out Refinances Gaining Share, but Not the Macro Impact that You Might Think

Friday, December 1, 2017 by Zelman & Associates

Filed under: home improvementmortgagerefinance

Last week, Freddie Mac released its quarterly refinance statistics for 3Q17. The analysis uses a sample of properties where Freddie Mac has funded two successive conventional, first-mortgage loans, and the latest loan is for a refinancing. The data provide a useful proxy for how refinance borrowers are behaving as well as the typical characteristics of a refinance mortgage.

For the third quarter, 62% of refinance borrowers took out a mortgage that was at least 5% larger than the prior mortgage, indicating some equity extraction. This share has been rising alongside home price appreciation since bottoming in 2Q12 at 12%, as one might expect; however, the pace of acceleration of late shows that originators are pushing harder in this direction as the overall refinance environment slows. For example, for the 17 quarters from 2Q12 through 3Q16, the share extracting equity increased 28 percentage points while it rose another 20 percentage points in just the last four quarters. Since 1990, the median share taking out equity was 53%, leaving the trailing two quarters at above-average levels for the first time since 4Q08.

However, while this data suggests that a heavy portion of home equity is being withdrawn by homeowners, it is important to realize that the sample is of mortgage holders refinancing, not all mortgage holders. Thus, a rising share within a smaller universe offers a different conclusion than what the headlines might imply.

As we have noted previously, we believe that our mortgage finance estimates and forecasts are unique in that we separate units from dollars, allowing for more thoughtful analyses given that downpayments, mortgage products, equity extraction and home price appreciation have varied through time. For refinances, we can then combine the share of mortgage holders that are refinancing with the share of refinancers that are taking out equity to arrive at the most meaningful number for the economy, which is the share of mortgage holders actually extracting cash from their homes.

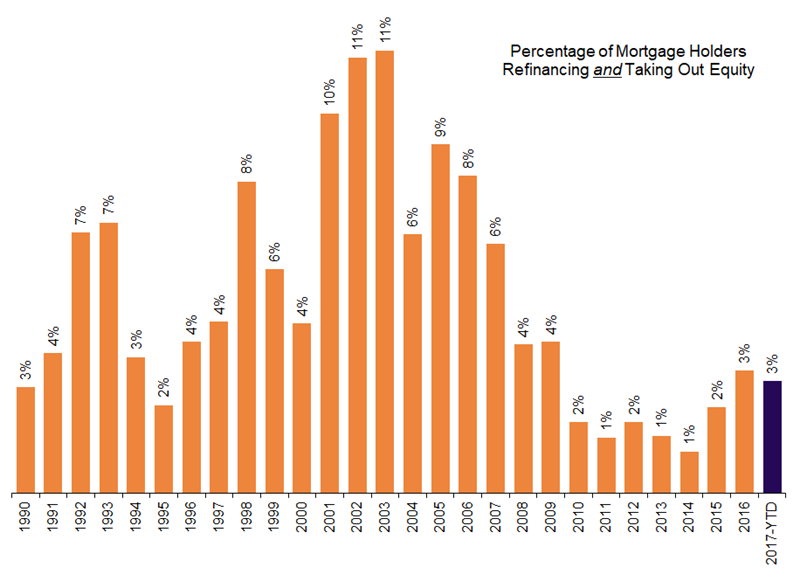

Specifically, in 2016, we estimate that 3.76 million owner-occupied refinance mortgages were originated, equal to 7.5% of those outstanding. That was higher than 6.3% in 2015 and compares to the range of 3.0-30.8% since 1990. Combining our data set with that of Freddie Mac suggests that approximately 3% of mortgage holders withdrew equity through a cash-out refinancing during the year. While higher than 1-2% the prior six years, it still stood on the lower end of the historical median and is well below the 10-11% level reached during the 2001-03 refinance boom.

Thus far in 2017, although the share of refinancers taking out equity has notably risen, the fact that we expect unit refinancings to decline 32% causes the share of mortgage holders extracting equity to actually decrease modestly.

With the 2017 share standing lower than 18 out of the 20 years from 1990-2009, it stands to reason that the strength in home improvement spending is largely driven by consumer confidence in housing and a reallocation of discretionary spending versus equity extraction on big-ticket projects. We view this favorably and supportive of our position that the home improvement cycle is closer to mid-cycle than late-cycle. Along those lines, as of our last macro housing forecasts, we project national home improvement spending growth of 5.3% in 2017 and 2018 followed by 4.9% in 2019, all of which would be in excess of overall consumer expenditure growth.

Friday, December 1, 2017 by Zelman & Associates

Filed under: home improvementmortgagerefinance

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey