Home Improvement Outlook Strong, but Discount Overly Optimistic Forecasts

Friday, January 26, 2018 by Zelman & Associates

Filed under: home improvementsurvey

It is our opinion that no single data source appropriately captures consumer home improvement spending trends, with limitations for many of the often-cited statistics such as retail sales for building material locations and construction spending put-in-place provided by the Census Bureau or the Leading Indicator of Remodeling Activity (LIRA) produced by the Joint Center for Housing Studies (JCHS). For this reason, we produce a proxy home improvement index that is heavily tied to factual results from our proprietary building products survey and same-store sales growth for The Home Depot (HD), Lowe’s Companies (LOW) and hardware co-op chains.

While 4Q17 results have not been finalized for all data points included in our proxy index, we expect 2017 growth to finish very close to the 5.3% generated in 2016. While this slightly trails estimated growth of 6.0% in 2015 and 5.7% in 2014, it stands stronger than the increase in overall consumer expenditures for the sixth consecutive year, which we believe is the truest testament that the consumer is strongly engaged in home improvement discretionary spending.

Our existing outlook for 2018 calls for growth to accelerate modestly from 2017 as many of the housing-related pillars, particularly consumer confidence and home price appreciation, remain in effect and drive above-average engagement in the category. The modest benefit to cash flow from tax reform for the majority of consumers could be a minor tailwind on top of that existing view.

Positioned more optimistically than our outlook, through the LIRA, the Joint Center for Housing Studies noted in its latest outlook last week that “despite continuing challenges of low for-sale housing inventories and contractor labor availability, 2018 could post the strongest gains for home remodeling in more than a decade”, and predicted that 2018 home improvement spending would increase a robust 7.5%. This forecast would stand 110-240 basis points ahead of its estimates for the last five years that overlapped the housing recovery.

It is important to note that LIRA results since 2015 are based on what JCHS’s regression model says should have happened using factual housing-related inputs such as permits, starts, existing home sales and home prices. This interjects uncertainty not only into the outlook, but also recent historical results that serve as a benchmark.

Furthermore, the LIRA was revised lower from initial forecasts each of the last two years. In April 2016, 2016 spending was predicted to be 8.6% and the estimate now stands at 6.5%. Similarly, in April 2017, 2017 growth was forecasted at 6.9% but the current estimate is now 60 basis points lower.

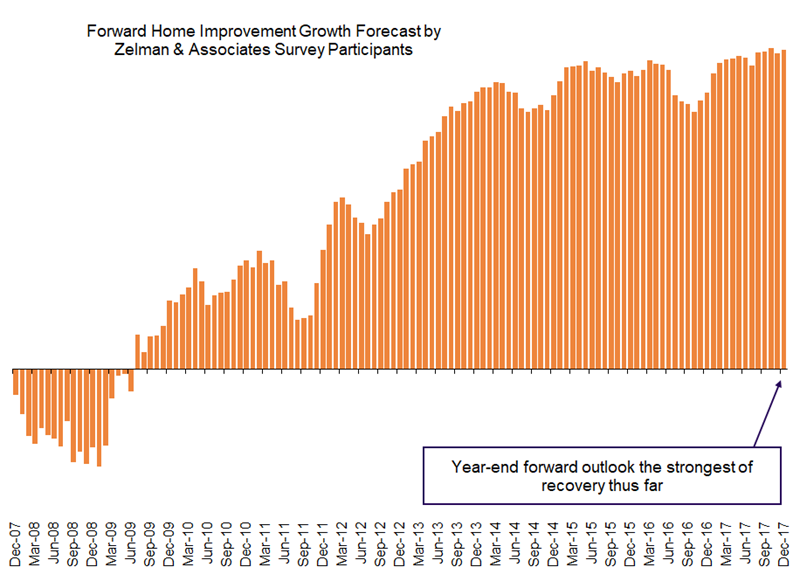

Optimism is certainly elevated among industry participants, with our proprietary home improvement spending outlook index derived from our monthly survey finishing 2017 at the best year-end level of the recovery thus far. Nevertheless, we expect 2018 to be a year where home improvement spending is strong – similar to the last handful of years – but we do not presently foresee a case for material acceleration at this point in the cycle.

Friday, January 26, 2018 by Zelman & Associates

Filed under: home improvementsurvey

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey