How at Risk is Homeownership with Mortgage Interest Deduction Deemphasized?

Friday, January 12, 2018 by Zelman & Associates

Filed under: homeownershipmacro housing

There are several pieces of tax reform that directly or indirectly affect the housing market, but the degree to which these items matter has been a hot topic of debate since legislation was proposed and ultimately passed. The conversation has been most centered on the treatment of the mortgage interest deduction.

The new law states that mortgage interest on up to $1.0 million of debt will remain deductible on previously-originated mortgages. For mortgages originated after December 14, 2017, the new deductibility cap is $750,000. According to our analysis, only 2% of unit originations in 2016 were in excess of $750,000, suggesting that a very small share of homeowners would be affected by the change, and they would be heavily skewed to the highest income brackets. Thus, one would surmise that the change is insignificant. However, with the standard deduction being nearly doubled, only 5-10% of homeowners will likely claim the mortgage interest deduction under the new tax law versus roughly 40% previously, leading some to believe that it could overhang housing demand.

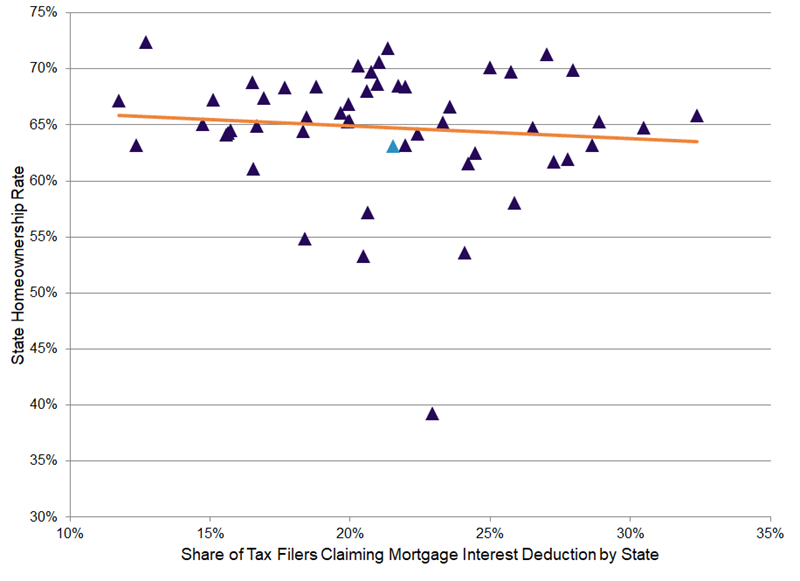

Although only time will tell whether deemphasizing the mortgage interest deduction will negatively affect the own-versus-rent decision, we do not believe that consumers analyze homeownership in the context of deductions, exemptions and tax credits. To help support this opinion, we compared the share of tax filers claiming the mortgage interest deduction to the homeownership rate for the 50 states and the District of Columbia.

South Dakota has the lowest percentage of tax filers taking the mortgage interest deduction (12%) out of any state and its homeownership rate (67%) is solidly above the national average (63%), as measured by the American Community Survey. In fact, the nine states with the lowest share utilizing the mortgage interest deduction have above-average homeownership, including North Dakota, West Virginia, Tennessee, Mississippi, Florida, Louisiana, Arkansas and Wyoming.

The counterintuitive facts go the other way as well with seven states having a relatively high share of tax filers claiming the mortgage interest deduction but a below-average homeownership rate. These notable outliers include California, Georgia, Oregon and Washington.

In our opinion, the mortgage interest deduction incentivizes debt more so than homeownership. More importantly, we believe that for any given set of demographic circumstances, homeownership is most highly correlated with income and the conversation should be focused on the net effect of all tax changes rather than picking one component and treating all else equal, which it is not.

Friday, January 12, 2018 by Zelman & Associates

Filed under: homeownershipmacro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey