Homebuyers Increasingly Choosing Mortgage Companies Over Local Bank

Friday, June 15, 2018 by Zelman & Associates

Filed under: mortgage

In 2005, we estimate that there were 6.6 million purchase mortgages originated, proving to be an all-time peak. At that time, even with the excessive level of subprime and low-quality loans that are often associated with non-banks, 66% of originations were by banks, followed by 32% for mortgage companies and 2% for credit unions. Over the prior decade, the bank share contracted from 75%, but the majority of borrowers still sourced their mortgage in this manner.

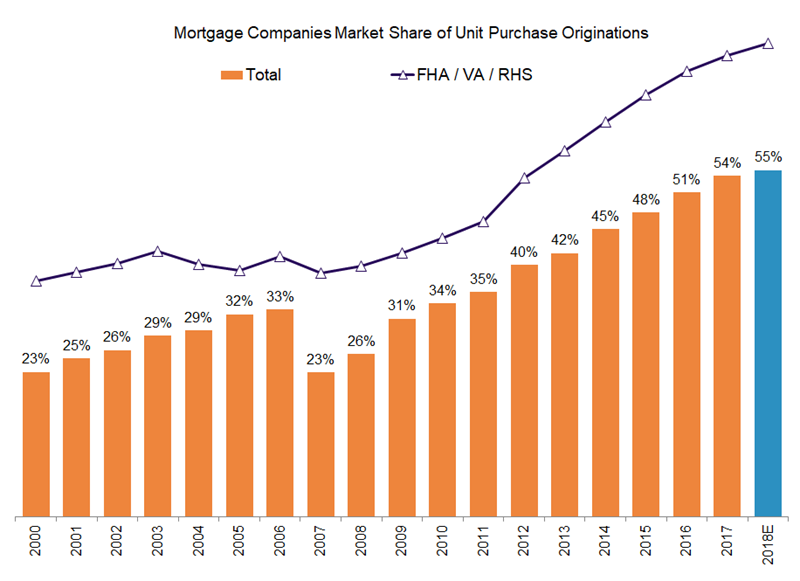

Fast forwarding past the credit crisis and recent housing recovery, the table has flipped with mortgage companies responsible for 54% of purchase unit originations last year, followed by banks at 40% and credit unions at 7%. Put another way, 2017 purchase originations are still 30% lower than the 2005 peak, which is entirely driven by a 58% drop for banks while mortgage companies have increased 18% and credit unions are up 125%. Of course, the banks and mortgage companies of today are in many cases different than those around during the bubble, but the underlying market share shift is still very notable.

Segmenting origination activity for mortgage companies further, in 2017, their 54% overall market share was led by 78% for FHA loans, followed by 64% for VA loans while the conventional segment was lower at 45%. Grouping FHA, VA and, to a lesser extent, Rural Housing loans, the “government” share for mortgage companies was 39% in 2005, higher than their overall market share (32%) but the differential was not as extreme as it is today.

In many ways, the outsized growth of non-banks has been driven by a willingness to originate under FHA and VA guidelines at the same time the banks have intentionally pulled back because of fines and litigation that related to crisis-era faults. Based on our analysis of securitization activity thus far in 2018, this market share shift is still ongoing. We estimate that mortgage companies will increase their overall market share to almost 55% this year, including pushing the government share to 75% from 73% in 2017.

There is much debate about whether shifting market share away from regulated depositories carries downstream risk to the mortgage finance system. We can see merit to both sides of the argument. On one hand, we believe underwriting quality is quite strong for banks and non-banks alike and worry little that the sins of subprime underwriting are permeating the market again, which is the perception we encounter frequently. On the other hand, for banks, capital regulation is more significant and liquidity is more substantial to weather unexpected disruption in the servicing or funding side of the business, so too much reliance on mortgage companies could be problematic down the road.

Given the pressure on refinance originations, the likelihood of higher interest rates moving forward and increasing regulatory and technology costs required of mortgage originators, we foresee a combination of smaller originators going out of business and consolidation of more established companies, largely on the non-bank side of the equation. As these companies increase further in size, their ability to sustain market volatility should surely be part of mortgage finance reform debate.

Friday, June 15, 2018 by Zelman & Associates

Filed under: mortgage

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey