How Big Could the Next Housing Downturn Be?

Friday, June 29, 2018 by Zelman & Associates

Filed under: macro housing

While economic activity appears to have accelerated so far in 2018, some prominent economic forecasters have become more cautious about growth prospects for 2019 and 2020. For instance, in early June, former Federal Reserve Chairman Ben Bernanke noted the stimulus from recent tax cuts “is going to hit the economy in a big way this year and next year, and then in 2020 Wile E. Coyote is going to go off the cliff.”

In such a scenario, we are often asked “What would a recession mean for housing?” There are obviously many factors at play behind any housing cycle, most prominently the macro backdrop, the trend of interest rates, consumer confidence, mortgage credit availability, inventory and demographics. While we do not pretend to double as macroeconomists, with respect to housing, we simplify the conversation to employment and consumer confidence, which are heavily linked, given that housing has rarely declined without a substantial deceleration in employment.

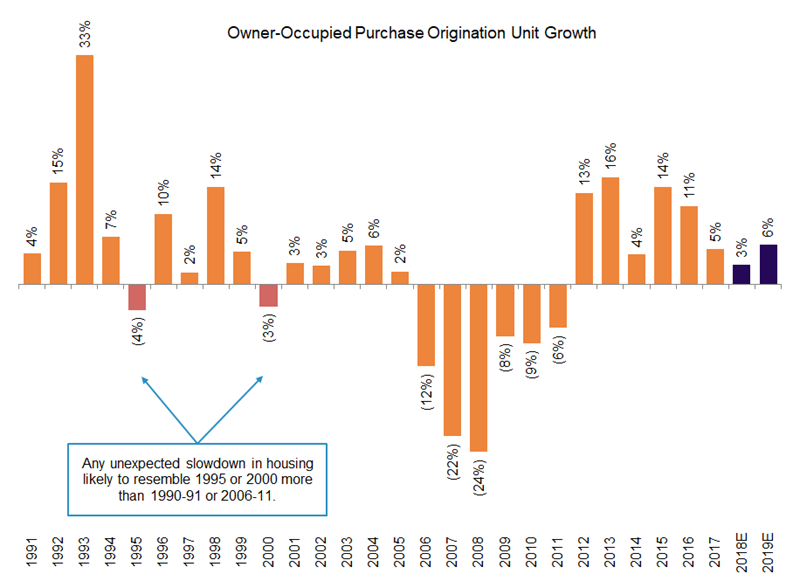

In considering historical precedents, we look to the 1995 and 2000 housing slowdowns given that the 1990-91 and 2006-11 declines overlapped recessions caused by housing. For our analysis, we focus on the change in owner-occupied purchases using a mortgage. We choose this time series given a robust history, a sample size of over 90% and the theory that investor and cash purchases are more discretionary than financed owner-occupied purchases.

In late 1994, 30-year mortgage rates were elevated at 9.1% and up roughly 200 basis points year over year, creating a headwind to housing demand entering 1995 at the same time that employment growth was peaking. However, mitigating this downside, for-sale inventory was tight at 1.9% of households and the 1.6% trough in employment growth in January 1996 was still relatively strong in absolute terms. As a result, only a modest housing downturn unfolded with owner-occupied mortgaged purchase closings dropping just 4% in 1995. While production new home closings declined a more significant 10%, the slowdown proved short-lived and closings rebounded to a robust 20% growth rate in 1996. From a pricing standpoint, in 1995, nominal home price appreciation averaged 2.1% versus 2.8% in 1994, suggesting that the weakness in transactions modestly pressured pricing power.

In the following downturn, the aftermath of the technology and stock bubble drove employment growth from 2.6% in March 2000 to negative 1.5% by February 2002. Inventory was tight again at 1.9% of households while easing monetary policy led to an approximate 130 basis point drop in 30-year mortgage rates over the same time frame to 7.0%. As a result, owner-occupied mortgaged purchase closings were down just 3% in 2000, with production new construction closings – typically more volatile – down just 3% as well. Unlike the 1995 slowdown, home price appreciation actually accelerated meaningfully, increasing from 6.7% in 1999 to 8.1% in 2000 and 7.9% in 2001.

Bringing the conversation to the current environment, while a deceleration in employment growth is not our base case, if it were to unfold, we believe that housing demand would be dented, but any decline would be mitigated by three key points: (1) further significant increases in mortgage rates would be unlikely given the assumed economic weakness would likely result in an easing bias from the Fed amid still-constrained inflation; (2) inventory is actually significantly tighter than the prior two cycle examples at 1.4% of households, likely supporting home price appreciation; and (3) owner-occupied mortgaged purchases are still at below-average levels, with our estimate equaling 3.4% of households in 2018 versus 4.6% in 1999 and 3.8% in 1994. This latter ratio stands 11% lower than the 1990-2009 average of 3.8%. In fact, depressed activity is most evident for new construction at an estimated 0.8% of households in 2018, roughly 45% below the 1990-2009 average.

All told, while solid long-term demographic underpinnings support our positive fundamental outlook for housing, in the event macroeconomic headwinds surface, we would expect housing transaction volumes and home prices to weather the storm.

Friday, June 29, 2018 by Zelman & Associates

Filed under: macro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey