Student Debt Fears are Overblown – Here’s Why

Friday, June 15, 2018 by Zelman & Associates

Filed under: demographicshomeownershipstudent debt

According to our analysis of Census Bureau data, in 2016, 35% of 25-39 year olds had earned a Bachelor’s degree or higher, continuing a multi-decade increase. For comparison, the share stood at 31% in 2010, 27% in 2000, 24% in 1990, 23% in 1980 and 15% in 1970. In fact, the pace of higher education attainment has actually accelerated this decade, averaging 60 basis points per year, which only trails the 1970s over the last seven decades.

While one would typically assume that a pat on the back for society was in order, frequent negative headlines related to student debt seem to overwhelm the bigger picture. Just a few weeks ago, The New York Times published an article titled “How Student Debt Can Ruin Home Buying Dreams” that attributed lower homeownership rates among young adults to rising college borrowing costs. The argument is not new, but we find that articles like these often overlook important facts.

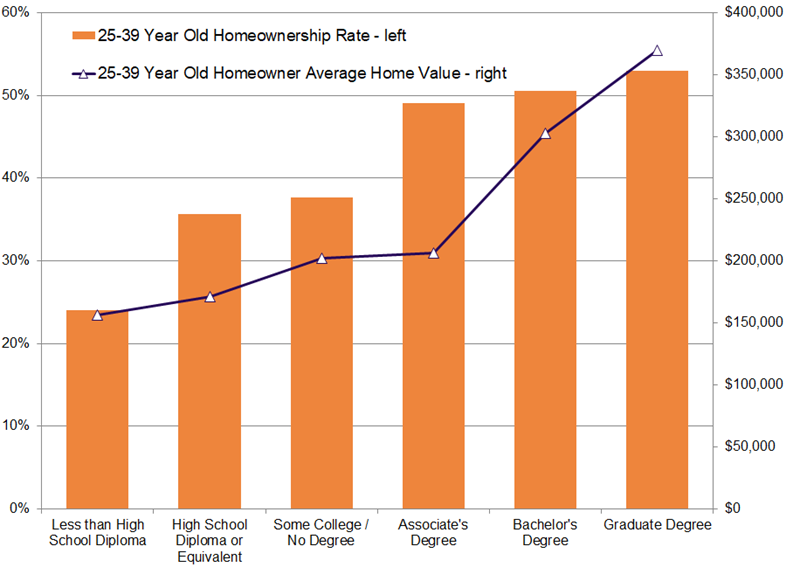

Using 2016 data from the American Community Survey, we note that the homeownership rate for 25-39 year olds stood at 43%. This ranges from households that never graduated from high school at 24% to those with a graduate degree at 53%. At every step higher on the educational ladder, homeownership improves. Thus, an upward trajectory on college participation should positively influence future homeownership rates, adjusted for cyclical volatility.

Furthermore, while the homeownership rate for associate degree holders (49%) is not materially lower than for those with a graduate degree (53%), the value of the home owned is significantly different, averaging $206,000 for the former and $370,000 for the latter. So, ignoring how higher education was financed, there are clear economic advantages achieved along the way.

Taking this a step further, researchers at the Federal Reserve Bank of New York recently published an informative blog post on the topic. While the entire post is worth a read, one chart in particular stood out. The analysis splits the sample of young adults into four groups: (1) attended college but never incurred debt; (2) attended college and incurred more than $25,000 of debt; (3) attended college and incurred less than $25,000 of debt; and (4) never attended college.

The homeownership rate curve is naturally steepest for the first group, as it is the best of both worlds – the income benefit of higher education and no student debt burden. But we focus more intently on the middle two groups to differentiate graduating with a little or a lot of debt. The more heavily-burdened borrowers trail these peers by only one year throughout their 20s with respect to homeownership attainment and they almost entirely close the gap by age 33. Furthermore, at age 33, the difference in homeownership is substantial between college graduates with more than $25,000 in student debt (~42%) and those that never attended college (~27%).

Reading this, would you encourage your child or grandchild to forego college if accumulating student debt was the only path to a degree?

Friday, June 15, 2018 by Zelman & Associates

Filed under: demographicshomeownershipstudent debt

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey