2018 Economic Activity on Pace for Biggest Upside Surprise This Cycle

Friday, July 13, 2018 by Zelman & Associates

Filed under: macro housing

Economists have the unenviable task of predicting the future across a wide host of sectors, handicapping international and political influences along the way. The crystal ball requirement obviously leaves the profession with a mixed track record. For us, rather than focus on the accuracy of predictions, we utilize economists’ forecasts as a gauge of current sentiment and a means to understand when and why sentiment has shifted.

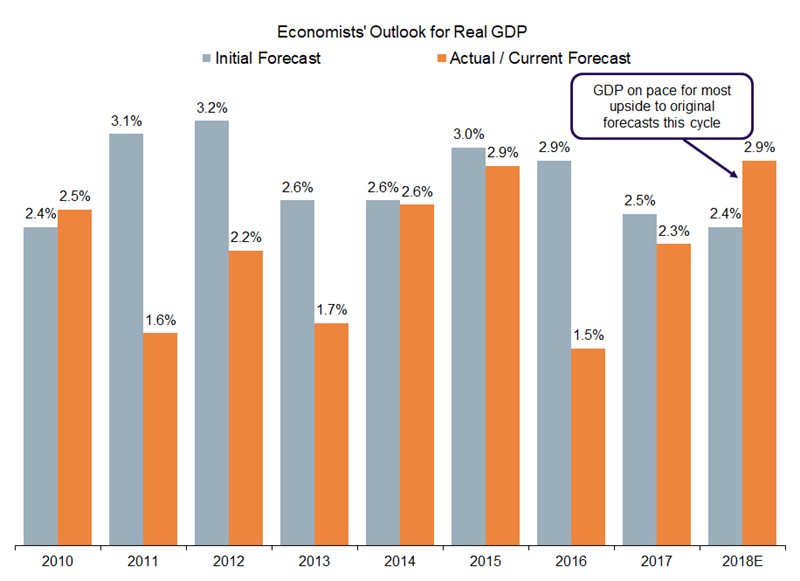

As we analyzed in July of last year, throughout this economic cycle, optimism has run high as the overhang from the Great Recession shifts further into the rear view mirror. However, a return to 3.0% or better real GDP growth has proven elusive, and economic activity has for the most part disappointed expectations. For example, when comparing initial GDP forecasts from January of the preceding year with the final result, 2017 marked the sixth shortfall out of the last seven years. For the year, 2.3% growth was 20 basis points below the initial forecast and was only slightly ahead of the 2.1% average from 2010-16.

Positively, unless a notable economic disruption surfaces soon, this year appears set to buck the trend, in both relative and absolute terms. In January 2017, economists forecasted 2018 growth at just 2.4%, tying 2010 for the weakest starting point since the recession. However, that forecast stands at 2.9% today, with the 50 basis point upward shift the best for the last nine years by far. Ironically, when starting expectations were finally beaten down enough, upside became most pronounced. It is not just the relative upside that is worth noting as 3.0% growth appears within striking distance. Not since 2005 has the economy expanded by that magnitude, with 2014 (2.9%) coming closest since.

There are clear risks to the solid state of economic activity, including international trade disputes, on-going geopolitical risk, rising oil prices and interest rate uncertainty. However, risks are always present; they just change shapes and sizes. In most respects, the domestic economic backdrop is quite positive for housing with entry-level income growth just posting its best quarter since 4Q10 due to the strong employment environment, inflation still contained, confidence running high, available inventory depressed and recent interest rate increases leveling off.

With the economy finally surpassing expectations and the benefits of tax cut stimulus still unfolding, we believe a shift in the current positive housing momentum would be unlikely. As a result, we remain confident in our outlook for above-average increases in single-family new construction, home prices and home improvement spending through our 2020 macro forecasts.

Friday, July 13, 2018 by Zelman & Associates

Filed under: macro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey