Real Estate is Local, but the Macro Can Make or Break Your Business

Friday, July 13, 2018 by Zelman & Associates

Filed under: home pricingmacro housing

All real estate is local. That is a truism rarely doubted. It is often meant to convey that location matters more than most else and can often overcome other challenges. Taken further, many housing market executives spend an exorbitant amount of their time understanding local dynamics because they underpin their business.

However, as was learned last cycle, shifts in the macro environment cause normally uncorrelated events to become correlated. In our opinion, local market factors are more macro-dependent in nature than many appreciate and thus broader macroeconomic activity will likely remain the driving force of most local areas.

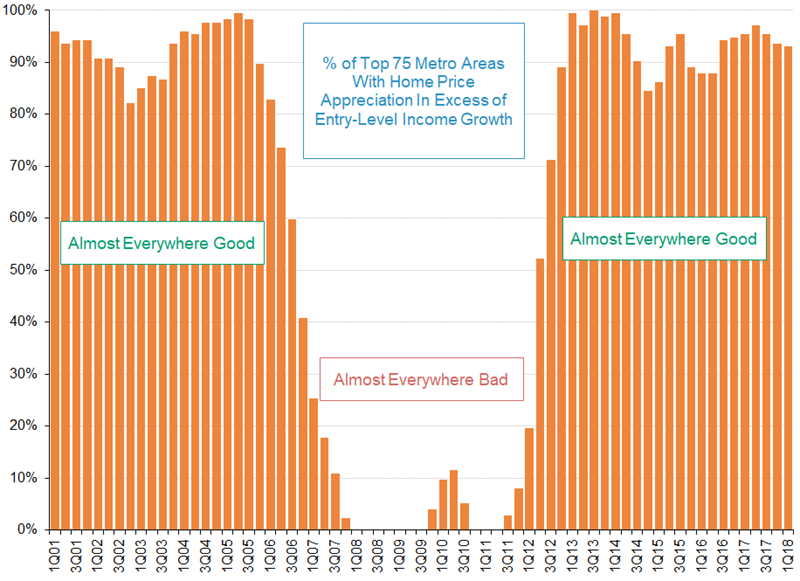

To help prove this point, we analyzed home price appreciation trends across the 75 largest metro markets over the last 17 years relative to income growth. Today, for example, entry-level incomes have expanded by 3.0% thus far in 2018. Meanwhile, home price appreciation is greater than this amount in almost 95% of these large markets. This has been the case every quarter since 2Q16. Furthermore, during this recent period of economic expansion, home price appreciation in at least 84% of the 75 biggest markets has outpaced income growth each quarter since 3Q12.

Alternatively, when macroeconomic headwinds were present from 4Q07 to 4Q11, home price appreciation fell short of income growth in at least 89% of markets, with every single large market underperforming on this measure in 10 out of those 17 quarters when the national housing crisis was underway. And from 1Q01 to 4Q05, the opposite was true again with at least 82% of the top markets surpassing income growth, averaging 93% for the 20 quarters.

In very blunt terms, population growth is the most important housing driver longer term. Driven by job opportunities, quality of life, affordability and migration patterns, population growth certainly varies across the country, creating different housing demand dynamics at the local level. But on the other hand, many housing market factors are national in scope, including mortgage rates, mortgage credit availability, demographic shifts and consumer confidence. We believe this is further augmented by the speed of information flow.

All told, we would never suggest that a real estate company could be successful without fully understanding local market trends. But, ignoring macro trends or assuming that they do not carry the same weight would be an equally erroneous suggestion. In our experience, the most effective industry leaders and investors appreciate the appropriate balance between the two ends of the spectrum.

Friday, July 13, 2018 by Zelman & Associates

Filed under: home pricingmacro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey