Young Adult Homeownership Rises Again and We’re Optimistic it is Just the Start

Friday, July 27, 2018 by Zelman & Associates

Filed under: homeownershipmillennials

According to data just released by the Census Bureau, the national homeownership rate continued its cyclical recovery, averaging 64.3% in 2Q18. This is 60 basis points stronger than in 2Q17, marking the sixth consecutive quarter that year-over-year improvement was evident. In absolute terms, the quarterly rate was the highest since 3Q14.

Naturally, young adults are the needle mover as they are more prone to change housing circumstances and are also the most cyclical age cohort, with homeownership contracting more than average during economic downturns and rebounding at an above-average rate when the economy is on the upswing. In the second quarter, the year-over-year increase in the homeownership rate was led by 30-34 year olds (270 basis points), with the four next oldest age cohorts through 50-54 year olds all expanding at an above-average rate.

Looking specifically at 25-39 year olds that are most likely to be in the family formation period of their lives, the homeownership rate improved by 120 basis points, putting the year on track to average 46.4%. This would represent the highest rate since 2012, marginally surpassing 2013.

While there are many homeownership skeptics, albeit fewer than two years ago, the recent improvement is actually directly aligned with the behavior of young adults following the last deep housing recession. Since World War II, the most severe contractions in single-family housing starts occurred from 1977-82 (down 54%) and from 2005-09 (down 74%). Around those downturns, the national homeownership rate peak in 1980 (65.6%) and 2004 (69.0%).

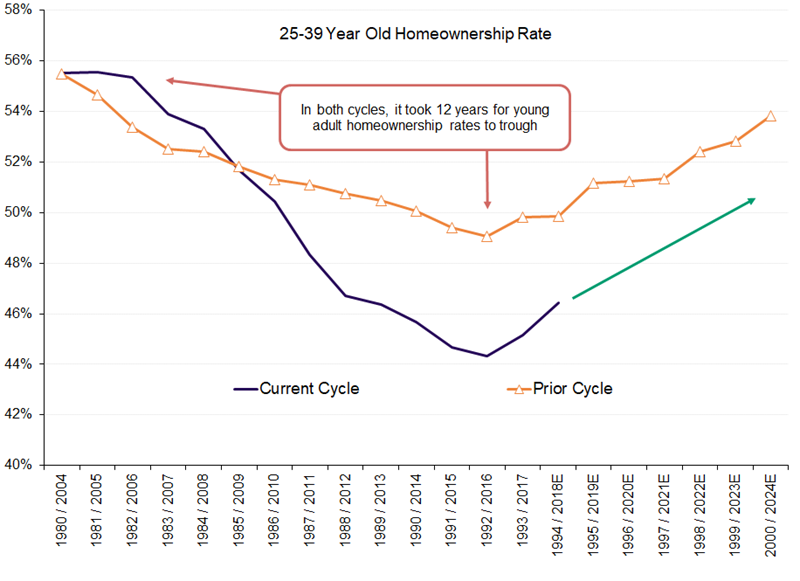

The homeownership rate for 25-39 year olds peaked at 55.5% in both 1980 and 2004, and in both forward periods, it took 12 years for the rate to trough. The total contraction was more significant in the current cycle (down 1,120 basis points) than the historical one (down 640 basis points), which aligned with the more substantial pullback in housing fundamentals. Now the reverse has been true, as young adult homeownership rates are rebounding faster, up an estimated 210 basis points from 2016-18 versus 80 basis points from 1992-94.

Finally, as we look forward to the next several years, we are further encouraged that 25-39 year old homeownership rates climbed 400 basis points from 1994-2000 even though 30-year fixed mortgage rates were largely unchanged between the two years at 8.35% in 1994 and 8.05% in 2000. Despite all the noise of affordability constraints, student debt, a preference for mobility, etc., our conclusion is that rising young adult homeownership is actually in the early stages of a multi-year cyclical recovery.

Friday, July 27, 2018 by Zelman & Associates

Filed under: homeownershipmillennials

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey