Refuting Three Common Misperceptions of Wall Street Single-Family Landlords

Friday, September 21, 2018 by Zelman & Associates

Filed under: institutional investorssingle-family rental

In 2004, when homeownership was at an all-time high, there were over 11 million single-family rental households that provided shelter for over 32 million people. Although renting a home has always been a housing option, representing more than 10% of households over the last seven decades, it had often been overlooked due to the more sizeable multi-family rental market. It was not until institutional investors began to acquire, rehab and rent thousands of single-family homes that mainstream media took notice.

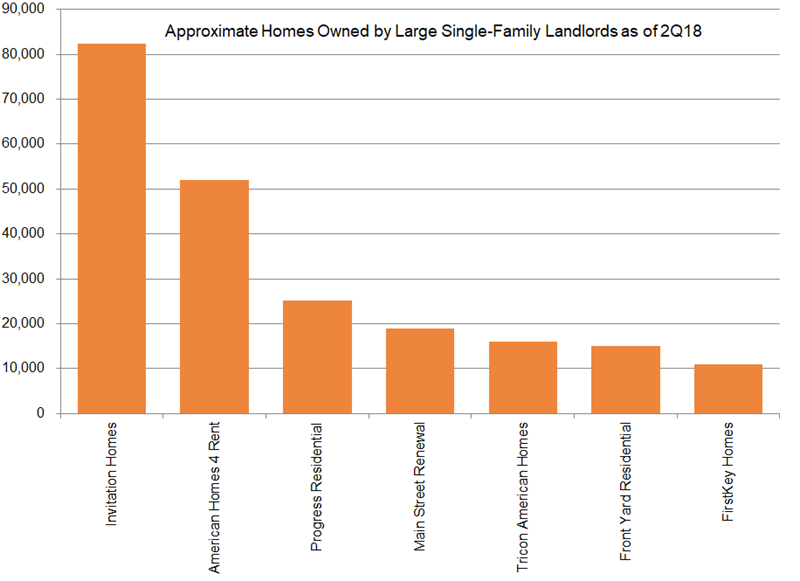

As of today, Invitation Homes (~82,000 homes) and American Homes 4 Rent (~52,000 homes) are the largest single-family landlords in the country. FirstKey Homes, Front Yard Residential, Main Street Renewal, Progress Residential and Tricon American Homes are also large scale companies with ownership of 10,000-30,000 homes, and growing. When institutional investors were in the early stages of capital deployment in 2012 and 2013, skepticism about their sustainability was extraordinarily high. Even 5-6 years later, we find more confusion than understanding of their impact on the overall housing market. We are commonly faced with three views that we will address in turn: (1) single-family investors serve as unfair competition to first-time home buyers; (2) single-family investors are a major reason why existing home for-sale listings are too constrained; and (3) single-family investors create risk to the broader housing market because they could change their strategy and sell in bulk.

First, single-family investors create the most value in finding well-located homes that require substantial upfront investment. These capital improvements can cost $10-30,000 or more. Many entry-level homebuyers cannot afford such expenditures on top of a mortgage downpayment, and/or they do not have the expertise or desire to endure a large scale home remodeling project.

Second, the seven largest single-family landlords collectively own approximately 220,000 homes. If we assume that these homes were instead owned by a family and that a typical young family moves every 5-7 years, it would mean that incremental for-sale listings would be only 30-45,000 higher than at present. That would lift for-sale inventory by a mere 2% — hardly a game changer.

Third, the Achilles heel of single-family rentals is vacancy. One has to appreciate that these single-family homes are occupied. Selling them all at once would either require a portfolio sale, which in that case would have no impact on visible supply, or would require waiting for every lease to expire and every tenant to move out before listing. In a worst case situation (from the market’s perspective), it would take over a year to dispose of an entire portfolio. And this assumes that an entity that spent years investing in technology and operational expertise would have any interest or incentive in doing so.

We understand that not all landlords operate in the best interest of a community, and not every institutional investor is on equal footing, but it is not debatable that they are providing a home for an individual or family. It is supply that is occupied and changing the ownership structure would not change the fact that the family would have to live somewhere. It would not create more inventory. It would simply become a game of musical chairs.

Friday, September 21, 2018 by Zelman & Associates

Filed under: institutional investorssingle-family rental

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey