Has the New Home Premium to Existing Homes Gotten Too Wide?

Friday, October 5, 2018 by Zelman & Associates

Filed under: affordabilityhome pricinghomebuilding

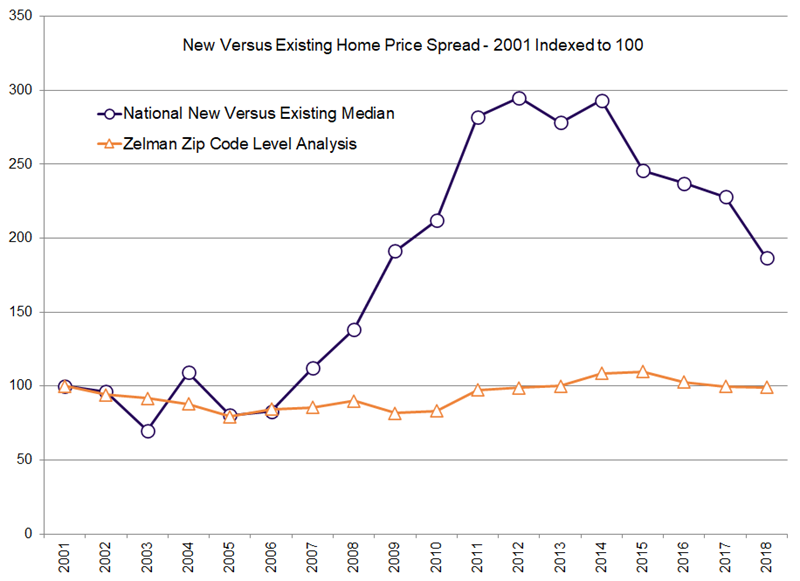

Of late, there is an argument surfacing that new home pricing has become too expensive relative to the existing home alternative. It goes something like this: the median new home price reported by the Census Bureau over the last four quarters (~$325,000) is almost 30% higher than the median existing home sales price calculated by the National Association of Realtors (~$255,000). This compares to a historical premium that is closer to 15%. However, there are significant flaws to this rationale.

To start, we believe there is little to gain from national median figures when geographic and price point mix are so important to the equation. For instance, the South and West regions of the country account for 62% of existing home sales but 82% of the new home market. Put another way, the Midwest and Northeast portions of the country account for 40% of single-family housing stock but only 18% of new construction given tighter land availability and slower population growth. Does it really make sense to compare national medians with this in mind?

In addition, beyond geographic mix, the high-level comparison fails to properly account for what we believe is an expanding divergence between the characteristics of new construction and existing stock. Most obvious, the median new single-family home built in 2018 will be approximately 2,400 square feet, which is 40% larger than the 1,750 square feet of the existing stock. With the size of new construction on an almost-uninterrupted upward trajectory over the last 30 years, that differential has not been static — it too has been expanding over time. That is missed in most discussions on the topic.

Beyond size, new homes also are more energy efficient, more technology enabled and designed with current tastes in mind. On the other hand, development tends to occur further from existing employment centers where land is available and the average lot size has been shrinking over time as well. Thus, the land value underneath a new home is typically less valuable than an existing home.

In an attempt to incorporate these various mix factors, we analyzed every zip code in the country and found over 11,000 where there was an adequate sample of new and existing home transactions for every year dating back to 2001 to assess the pricing differential relative to history.

Thus far in 2018, the median premium across the 11,000 zip codes was 37%. While wider than reported by the national median statistics, the calculation is void of geographic mix issues, largely controls for variation in land quality and actually better aligns with the significant difference in square footage and amenities. The premium has actually shrunk each year since peaking in 2015 and stands only slightly higher than the 2001-17 average of 35%.

In fact, looking at the historical trend also reveals one obvious conclusion — when new construction volumes are elevated, like in 2003-06, new construction premiums are compressed, and when supply is constrained premiums are above-average. Economics 101.

That leaves us with the outlook. We simply believe that the consumer is too intelligent and information is too transparent for an unjustified pricing dynamic to be unfolding today. Over the next several years, we assume that new construction single-family supply will continue increasing and that it will be more skewed to entry-level volume as builders have ramped land investments in recent years for that price point. If that view unfolds, the new versus existing premium will likely continue a gradual downward trend. This stands in contrast to views that a greater structural shift is required of the new home market.

Friday, October 5, 2018 by Zelman & Associates

Filed under: affordabilityhome pricinghomebuilding

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey