Can We Trust What Senior Loan Officers are Telling the Fed?

Friday, November 16, 2018 by Zelman & Associates

Filed under: construction lendingmacro housing

Once a quarter, the Federal Reserve conducts a survey of senior loan officers at large domestic banks and U.S. branches of foreign banks. The results of the October 2018 survey were just released, with approximately 65-70 responses received for the questions related to residential and non-residential construction.

According to the Fed’s survey, banks have been skewing credit standards more conservatively over the last year, but this appears to be at complete odds with the various surveys we conduct of market participants that are on the other end of banks’ decisions.

In the October survey, the share of respondents that reported tightening terms for construction and land development loans for residential and non-residential projects was 600 basis points higher than the share reporting looser standards. In other words, on balance, conditions tightened. This is the 14th consecutive quarter that net tightening was reported.

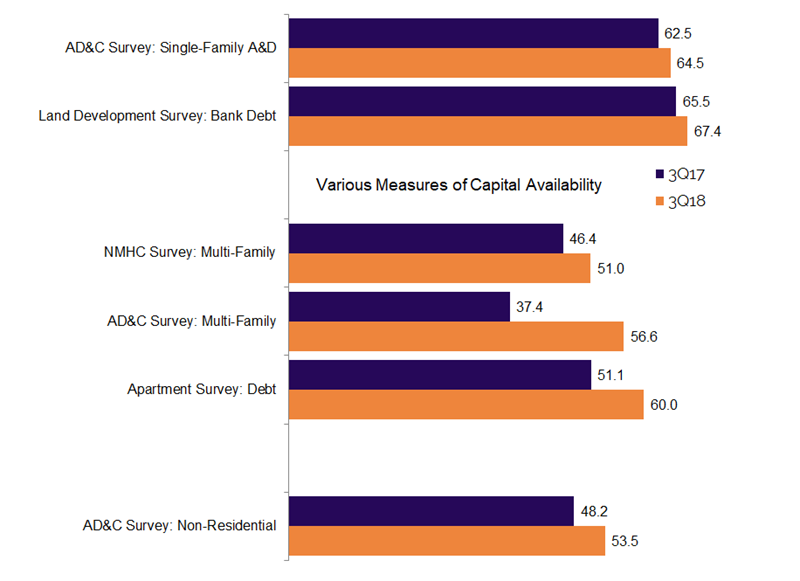

Conversely, homebuilders and developers participating in our quarterly land development survey rated the availability of bank debt at 67.4 on a 0-100 scale in 3Q18, up from 65.5 a year ago. The same trend was true for lenders participating in our acquisition, construction and development (AD&C) survey, which scored the availability of single-family debt at 64.5 on a 0-100 scale, higher than 62.5 in 3Q17. The apparent disconnect is not isolated to the single-family market.

For multi-family, operators and developers participating in our monthly apartment survey rated debt capital availability at 60.0 in 3Q18, expanding from 51.1 in 3Q17. Lenders in our AD&C survey quoted multi-family availability at 56.6 in 3Q18, significantly higher than 37.4 in the year-ago period. Finally, the National Multifamily Housing Council’s (NMHC) quarterly survey of market conditions revealed a diffusion index of 51.0 for A&D financing, also higher than 46.4 in 3Q17.

Rounding out the entire construction and land development sphere, lenders in our AD&C survey reported that capital availability for non-residential projects stood at 53.5 in 3Q18, above 48.2 in 3Q17, reaching the highest level since 2Q16.

So to review, homebuilders, residential land developers, apartment developers and lenders to the entire residential and non-residential construction industry have all independently confirmed that capital availability expanded over the last year but the senior loan officers at major banks are telling their regulator that terms have tightened. Perhaps large banks are behaving more conservatively than the rest of the lending community, but more realistically, we believe the high-level message being conveyed to the Fed, as a regulator of banks, is less reliable than feedback from those closest to the transaction.

Friday, November 16, 2018 by Zelman & Associates

Filed under: construction lendingmacro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey