Homeownership Rises Again as Single-Family Living Taking Share

Friday, November 2, 2018 by Zelman & Associates

Filed under: apartmentshomeownershipsingle-family rental

Over the last year, multi-family starts have accounted for 29% of all starts, close to the decade-to-date share at 31%. With this being notably higher than 20% in the 1990s and from 2000-09, clients often inquire as to whether we believe this is structural or cyclical. It’s a hotly debated topic that overlaps too many variables to discuss here. However, at the highest level of discussion, we point out two facts: (1) the homeownership rate is on pace for another solid increase in 2018; and (2) the single-family share of households has increased at the expense of multi-family in each of the last two years.

Starting with homeownership, the Census Bureau just reported the national 3Q18 rate at 64.4%, which was up both sequentially by 10 basis points and year over year by 50 basis points. This now marks the seventh consecutive year-over-year improvement, a streak last seen in 1Q05. Of the 12 detailed age cohorts disclosed, nine posted an increase from the year-ago period, tying the best breadth since 2Q04. The strongest improvement was notched by 30-34 year olds, up 210 basis points.

Although home purchase activity has slowed in recent quarters on the heels of higher mortgage rates, we believe that more likely reflects potential homebuyers staying put, versus moving and opting away from homeownership. It is an important distinction in our minds as the behavior of consumers at the point of a move is highly informative. It is essentially a clean slate to choose the most preferred living situation between asset type or ownership status.

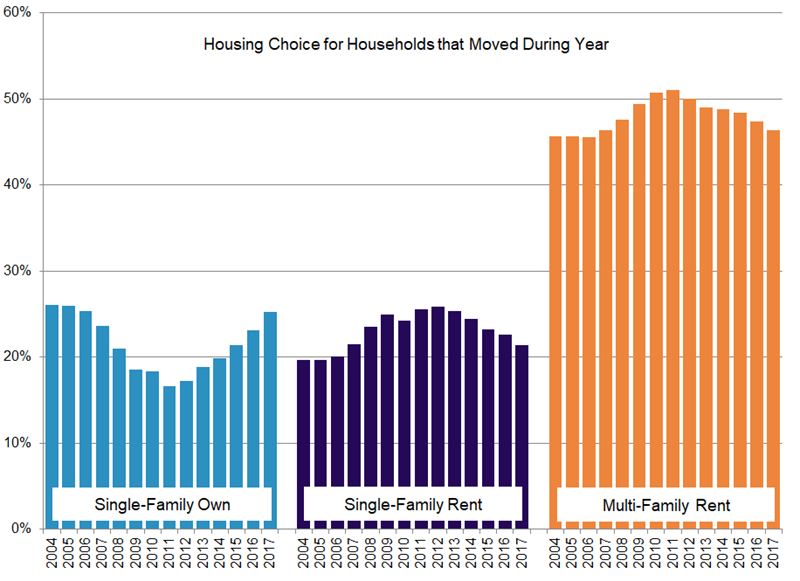

For example, according to data from the largest annual survey conducted by the Census Bureau, 46.6% of households that moved in 2017 chose a single-family home, up 100 basis points from 2016 to the highest share since at least 2004 when comparable data began. The share that chose single-family living and ownership was 25.3% in 2017, up 220 basis points from the prior year. This was the highest share since 2006 and was the largest single-year increase over the 13 years of data.

Naturally, the share gain for owned single-family housing comes at the expense of other asset types and rentals. The largest share loss occurred for single-family rentals (down 120 basis points), rentals in 2-4 unit multi-family buildings (down 70 basis points) and traditional multi-family rentals (down 30 basis points). Given the improvement in the national homeownership rate thus far in 2018, we suspect that the shifting of movers toward single-family owned housing is continuing, a dynamic that we do not believe is properly understood by market participants.

Friday, November 2, 2018 by Zelman & Associates

Filed under: apartmentshomeownershipsingle-family rental

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey