Is Fear of Homeowners Trapped by Low Mortgage Rate Justified?

Friday, November 30, 2018 by Zelman & Associates

Filed under: macro housingmortgage rates

According to Freddie Mac’s weekly survey, the effective rate for a 30-year fixed rate mortgage bottomed at approximately 3.30% in late-2012. From 2012-17, the rate was below 4.00% in 208 out of 313 weeks, or 66% of the time. With the latest reading close to 4.80%, the fear of many market observers is that existing homeowners are “trapped” with an attractively-priced mortgage and have little incentive to move, thereby creating risk to the housing market.

Per data provided by the Bureau of Economic Analysis (BEA), the effective mortgage rate on outstanding mortgages was estimated at almost 3.80% in 3Q18. This includes both fixed rate and adjustable rate mortgages. Excluding adjustable rate mortgages, we estimate that the current outstanding mortgage rate for homeowners would be approximately 4.05%. Thus, to maintain the same monthly principal and interest payment at the prevailing rate of 4.80% would require an 8% lower mortgage balance. Under these terms, trading up becomes more challenging for homeowners.

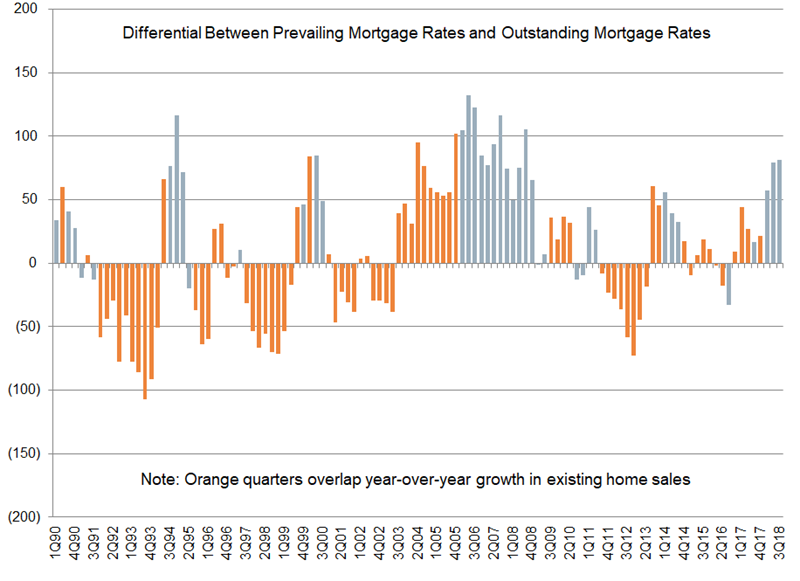

However, while the absolute level of interest rates reached historic lows in recent years, this dynamic of the prevailing rate being higher than homeowners’ existing rate is not new. To prove this point, we compare Freddie Mac’s estimate of prevailing rates to the BEA’s estimate of outstanding effective mortgage rates. In 3Q18, the differential was 81 basis points, the highest since 3Q08. This is not unprecedented territory as the gap was at least 75 basis points in 17 other quarters since 1990, or roughly 15% of the time. Looking even further back in history, prevailing rates were at least 55 basis points higher than outstanding rates in every quarter from 1977-85, averaging 315 basis points.

Clearly, falling mortgage rates are a tailwind for housing and vice versa. That is not up for debate. But it is unclear how housing turnover might evolve if rising rates do not reverse course. For the 41 years we have data, current rates have been at least 25 basis points higher than outstanding rates in 21 years and over that time, existing home sales increased 11 times and declined 10 times – almost a flip of the coin. This is also true if we exclude years prior to 1990.

There have been many paths to achieving growth in existing home sales over time. Although the conversation can be rightfully centered on interest rates, and another sizeable increase in 2019 would be difficult to digest, history suggests that it would be wrong to take a perceived increase in mortgage rates as given or assume that homeowners won’t move if they hold an attractive mortgage rate. Beyond entry-level buyers that do not have an existing mortgage rate to be concerned with, life events often overwhelm financial motivations to move and have been the catalyst behind existing home sales growth at other times of rising rates.

Friday, November 30, 2018 by Zelman & Associates

Filed under: macro housingmortgage rates

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey