With the Fed in Focus, What Can We Learn from Historical Actions?

Friday, November 2, 2018 by Zelman & Associates

Filed under: macro housingmortgage rates

Thus far in 2018, the average 30-year fixed mortgage rate has increased approximately 50 basis points year over year, putting the year on pace to have the highest borrowing cost since 2010. According to Google Trends, an index tracking how frequently “interest rates” was searched has averaged 44 year to date on a 0-100 scale, up from 38-39 the prior three years. In fact, the frequency of the search has been the highest since 2009.

Previously, we have emphasized that while policy from the Federal Open Market Committee (the Fed) directly dictates the direction of short-term interest rates, the influence on longer-term rates, such as the 10-year Treasury yield, is more indirect.

With the S&P 500 just wrapping up its worst monthly performance in over seven years and the housing market slowing on the heels of higher mortgage rates, the future of Fed policy has become cloudier of late. Some believe that the Fed will continue on its path of raising interest rates out of fear that inflation will continue to mount and worry that it could be too aggressive and tip the economy into a recession. The other end of the spectrum argues that inflation is relatively contained and the red flags in the equity and housing markets could actually motivate the Fed to raise rates more modestly than was assumed 3-4 months ago.

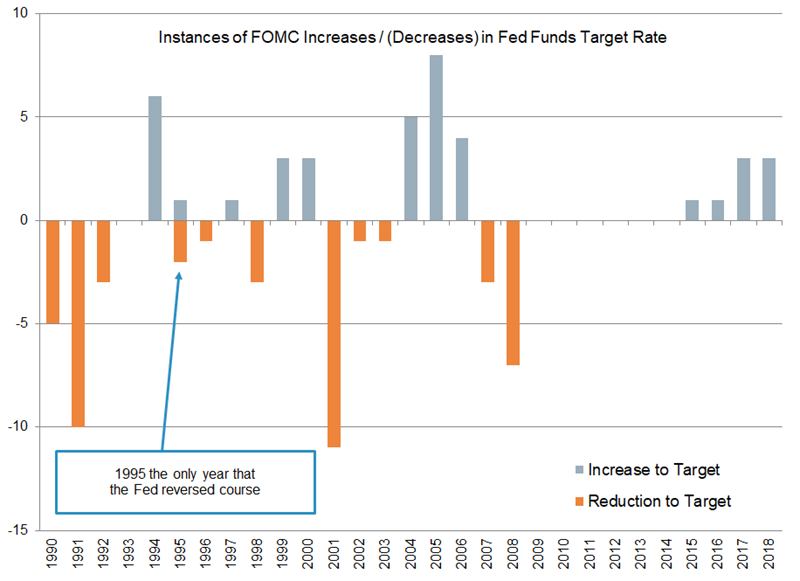

As we contemplate the potential outcomes, we thought it would be helpful to review historical Fed actions. Interestingly, since 1990, the Fed has increased or lowered the Fed Funds target rate in 22 out of 29 years. Six of the seven other years were from 2009-14 when rates were close to zero and could go no lower and quantitative easing became the next policy tool. The only other year that no action was taken was in 1993. So, annual Fed action is normal.

Perhaps not realized by the majority of market participants, in the 22 years of action, the Fed has only reversed course during the year once, in 1995. In every other year, it was either uniform tightening or easing of financial liquidity.

As it stands now, the futures market anticipates another 25 basis point increase in December and then not another one until May of next year, followed by December again. Thus, the most likely path according to investors is a 50 basis point increase in the Fed Funds rate next year. This view has moderated from what was roughly equal odds between two and three 25 basis point increases as recently as September.

With this backdrop, next year is setting up for an interesting outcome. History suggests that raising too fast and reversing course is a lower probability scenario. More likely from our perspective would be a balancing act between Fed policy and strength in financial markets and the housing sector, assuming inflation remains under control. If either is too weak, a slower tightening course would likely be pursued, which could ironically stimulate both. Positively, we do not believe that the importance of the housing market is lost on the Fed.

Friday, November 2, 2018 by Zelman & Associates

Filed under: macro housingmortgage rates

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey