Be Mindful as Media Sensationalizes Student Debt Impact on Housing

Friday, January 25, 2019 by Zelman & Associates

Filed under: student debt

As of the latest reading from the Federal Reserve Bank of New York, $1.4 trillion of student debt was outstanding in 3Q18, up 6.3% year over year, outpacing the increase in total consumer debt for the 57th consecutive quarter. Said differently, student debt now accounts for 11% of total consumer debt, up from 3-4% in the years leading to the Great Recession,

The prolonged increase has been driven by four primary factors: (1) young adult population growth; (2) the rising cost of college; (3) a greater propensity to pursue more expensive graduate studies; and (4) the increasing need for debt financing for incremental attendees.

Specifically, over the last 10 years: (1) the 18-34 year old population has expanded by roughly 9%; (2) the cost of college tuition and fees has increased 45-55% versus 25-30% for our gauge of entry-level income; and (3) young adult graduate program enrollees climbed 16%, surpassing overall growth in the cohort. With outstanding student debt up about 135% over this time frame, it would imply that at least half of the increase can be attributed to these three factors with the remainder driven by a need or desire to lean more heavily on debt financing.

Thus, the facts are clear that there has been a greater dependence on student debt over the last decade. The ambiguity is whether the debt is positive in net present value terms for society after considering intellectual progression and stronger income potential. The argument is particularly relevant for housing given the implications for leverage and credit quality of young adults.

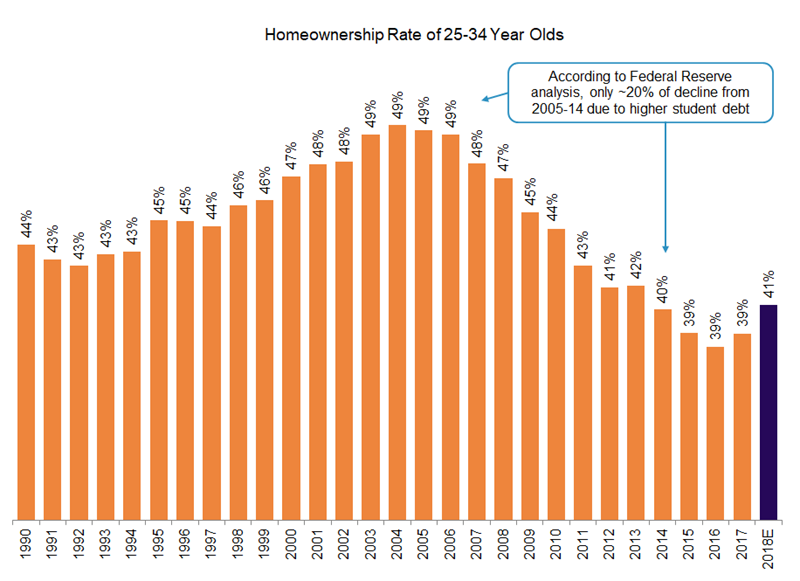

In a summary research publication last week, Federal Reserve economists attempted to isolate the impact of rising student debt on homeownership rates and concluded that “increases in student loan debt are an important factor in explaining lowered homeownership rates, but not the central cause.” The conclusion was quite reasonable and balanced from our perspective, but as usual, the ensuing media headlines were the contrary. As a selection:

- Fortune: “Why Aren’t Millennials Buying Houses? Their Heavy Student Loan Debt”

- The Wall Street Journal: “Fed Says Student Debt Has Hurt the U.S. Housing Market”

- CNBC: “Student Loan Debt Is Keeping Young People from Buying Homes, Fed Study Finds”

To rephrase the paper’s conclusion, 80% of the peak-to-trough decline in young adult homeownership rates was attributed to factors other than student debt, yet student debt is where the headlines focused. To deemphasize the dramatic impact of the financial crisis on employment, savings and family formation for young adults is highly questionable. Framed differently, the 2018 estimated homeownership rate of 25-34 year olds will be approximately 41%, higher than in 2014 even though student debt is more elevated today, pinpointing other factors as more relevant.

There are many factors to assess when connecting rising student debt with the housing market’s health, most of which are unfortunately overlooked by media articles shaping the rhetoric.

Friday, January 25, 2019 by Zelman & Associates

Filed under: student debt

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey