Industry Executives Quicker to Respond to Market Shifts than Economists

Friday, January 11, 2019 by Zelman & Associates

Filed under: home pricingsurvey

With total home closings estimated to have declined 2% in 2018, the first contraction since 2011, and inventory higher on a year-over-year basis for the first time since 2014, the home price appreciation outlook is coming under greater scrutiny of late.

In 3Q18, our summary index of existing home price trends was up 5.6% year over year. While very strong in isolation, the index has decelerated from a near-term peak of 6.6% in 1Q18, and we anticipate further compression will be visible when 4Q18 data are finalized, with our year-end estimate at 4.7%. If true, this would leave 2018 as the least positive inflation since 2011.

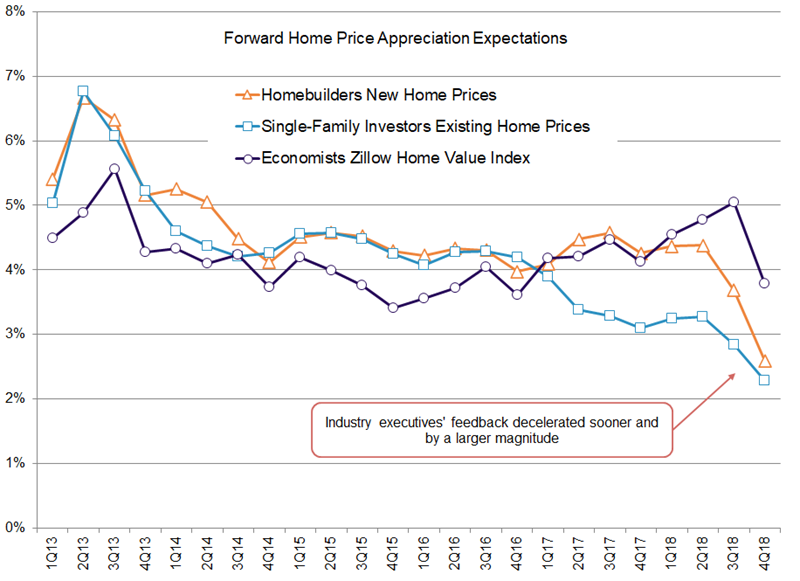

Beyond our own forecasts, we utilize data from our proprietary monthly surveys and compare that against a top down outlook from economists via a quarterly survey sponsored by Zillow to frame home price expectations.

Each month we ask homebuilders and single-family investors participating in our homebuilding and single-family rental surveys for their home price appreciation forecast over the forward 12 months. As of November 2018, homebuilders predicted a 2.4% increase for new homes while our single-family rental contacts predicted a 2.1% increase for existing homes. On a quarterly basis, these two time series have been 92% correlated, underscoring consistent fluctuations between the two sets of executives as they digest company-specific and market-level fundamentals. In both cases, the 4Q18 average through November represented the softest projection since 2Q12.

Meanwhile, more than 100 economists participate in the quarterly Zillow survey and are asked to provide the year-end forecasts for the Zillow Home Value Index. As an aside, we question the utility of this home price index as the latest reading for November 2018 of 7.7% seems inflated and the timing of the cycle peak appreciation of 8.0% in March 2018 is at odds with all other price measures. Nevertheless, this is the benchmark provided for participating economists.

Translating responses into an approximate forward 12-month measure to be comparable to our own surveys, economists most recently predicted 3.8% appreciation, down from 5.0% in 3Q18 but not materially different than the 3.4-4.5% average from 2014-17. Put differently, the variance between industry executives and economists widened to new extremes over the last two quarters as our survey participants have more quickly adjusted to the market reality.

To be clear, forecasts from all constituents have been too conservative throughout the housing recovery thus far, so we utilize our survey results as more of a sentiment gauge than an outright prediction. At this point, feedback strongly suggests that home price appreciation will decelerate in 2019. The question is by how much? We model 120 basis points of compression to 3.5%, but note that the direction of interest rates and the pace of further inventory additions will be critical to whether or not our outlook proves to be appropriate.

Friday, January 11, 2019 by Zelman & Associates

Filed under: home pricingsurvey

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey