Is Substantial Drop in Lumber Prices a Signal for Single-Family Housing?

Friday, January 11, 2019 by Zelman & Associates

Filed under: homebuildingmacro housing

According to Random Lengths, framing lumber prices in December were down 22% year over year and 41% from the monthly peak in June. Similarly, its structural panel composite index declined 14% year over year and stood 35% lower than the near-term peak. Additionally, futures pricing on framing lumber is trending down 27% year over year thus far in January, and would be down a substantial 24% for the entire year if current prices hold.

Given the historical volatility of lumber prices, stability is unlikely. Nevertheless, a 20%-plus decline has only been posted three times over the last 30 years (1995, 2000, 2015), demonstrating the quick shift in the market of late.

While lower prices should be a benefit to homebuilders and remodeling customers at the expense of lumber mills and suppliers, we are often asked if lumber prices are a signal for forward new construction activity. In other words, are lumber prices telling us to be worried about the housing outlook?

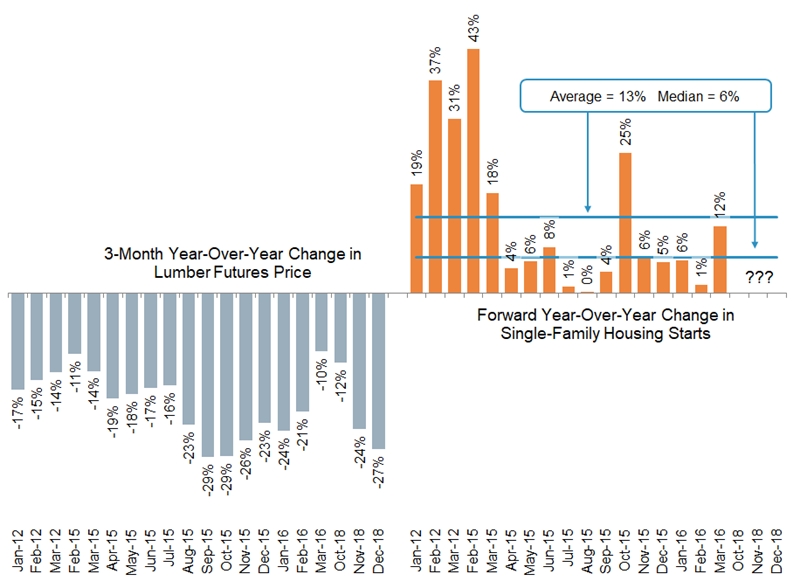

To potentially answer this question, we reviewed lumber futures pricing and single-family housing starts back to 1990. Over the 29 years, there have been 114 months where lumber futures prices were down at least 10% on a year-over-year basis for the trailing three months, or 33% of the time. If we further isolate periods when employment growth was at least 1.4% to indicate a healthy economic backdrop, the relevant sample drops to 74 months.

Looking at these 74 months, single-family housing starts expanded 60% of the time over the subsequent year – not overly impressive. However, if we exclude the early stages of the housing market meltdown in 2005-07, that figure jumps to 76%. Looking only at the current cycle improves the comparison even more. There have been 17 months where smoothed double-digits declines in lumber futures prices were registered and single-family starts one year later increased every time by an average of 13% with the median gain at 6%.

Conceptually, lumber prices are not so important as to dictate the direction of the housing market, but the data do suggest that substantial declines are actually a positive indicator of forward supply versus a red flag. Being the most significant cost of home construction outside of land and labor, it stands to reason that more favorable cost of goods sold influence homebuilders’ selling prices and potentially improve homebuyers’ affordability, just as elevated prices act in the opposite regard.

From this standpoint, it is reasonable that lower lumber costs in 2019 than 2018 could be a potential tailwind to single-family construction, assuming that macroeconomic conditions remain favorable and mortgage rates do not materially reverse course from their recent pullback.

Friday, January 11, 2019 by Zelman & Associates

Filed under: homebuildingmacro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey