Debating Risk, Merit of GSEs Accumulating Low Downpayment Market Share

Friday, February 22, 2019 by Zelman & Associates

Filed under: entry-levelmortgage

Like the three years prior, in 2018, approximately 45% of the $1.2 trillion of purchase mortgages originated was covered by mortgage insurance provided by private entities or the government via the FHA, VA or USDA programs. This suggests an equal balance of homebuyers unable or unwilling to put at least 20% down with those that can and do.

However, there have been significant market share swings within the low downpayment market over this time. For instance, the seven private mortgage insurers just reported 4Q18 new insurance written of $66 billion, up 7% year over year and bringing full-year growth to 14%. This was impressively stronger than a 12% increase in 2017 even though the overall purchase demand environment was clearly weaker.

Meanwhile, purchase originations through the FHA program declined an estimated 5% year over year in 4Q18 and roughly 8% for the entire year, representing sizeable underperformance versus the 14% gain for private mortgage insurers. With the FHA typically viewed as the option of last resort given easier underwriting criteria, a shift away would normally reflect positively on borrower credit quality. However, at the same time, GSE underwriting criteria loosened through the year, particularly for high debt-to-income borrowers, complicating that assessment.

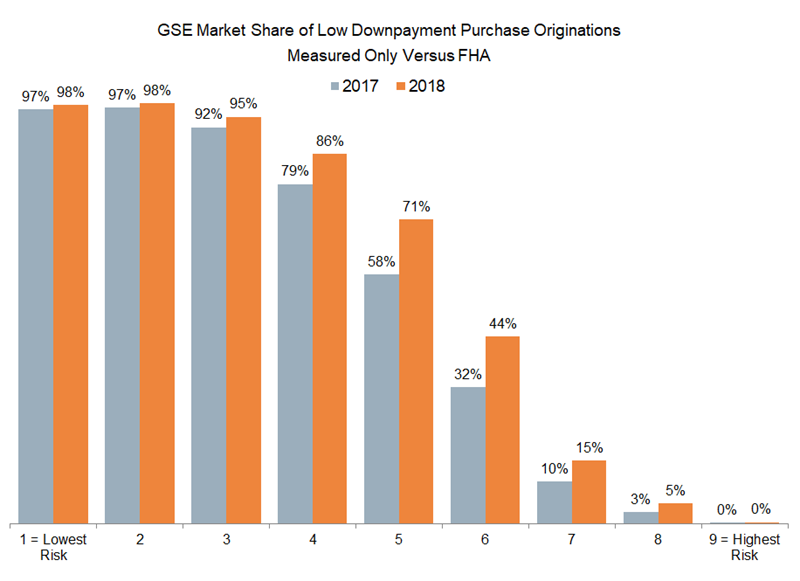

To better dissect the moving pieces, we analyzed underlying credit metrics for over 3.4 million low downpayment purchase mortgage loans securitized through the GSEs or endorsed by the FHA in 2017 and 2018. We simplistically scored each loan based on its downpayment, credit score and debt-to-income ratio on a 1-9 scale, with 1 associated with a very high-quality borrower and 9 representing risky attributes across all three metrics. Framed differently, loans scored at 8 or 9 on our scale would be synonymous with heavy “risk layering.”

In 2018, 74% of originations scored between 3 and 7 on our scale, with fairly even distribution throughout. Meanwhile, 11% of the total was scored at 1 or 2 and the remaining 16% was at 8 or 9. The average GSE loan was scored at 3.9 versus 6.9 for FHA, speaking to the higher entry-level and lower-quality skew for the FHA program.

Looking at market share between the GSEs and FHA, it is noteworthy that the GSEs gained share in each of the nine categories, highlighting slightly looser criteria during the year, reduced private mortgage insurance rates and lenders continuing to shy away from the FHA program due to greater perceived regulatory risk. The greatest increase in GSE share was in bucket number 5, climbing from 58% in 2017 to 71% in 2018. As an example, this could be a loan with a strong credit score over 700 paired with a 5-10% downpayment and debt-to-income ratio of 43-49%. GSEs also gained share at an above-average pace for loans scored at 6, 4 and 7.

In essence, middle-quality borrowers that require mortgage insurance increasingly opted for conventional loans at the expense of the FHA, a positive for affordability as private mortgage insurance is less costly for these cohorts than government insurance. However, this benefit is not without downside as the rapid shift in market share for this low downpayment segment of the market has not gone unnoticed by the GSEs and their regulator, the FHFA. The entities are already more closely monitoring risk layering attributes, which could cause some of the 2018 market share gains to unwind in 2019.

Friday, February 22, 2019 by Zelman & Associates

Filed under: entry-levelmortgage

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey