Historically Linked, Here’s Why Housing Outlook Far Superior to Autos

Friday, March 8, 2019 by Zelman & Associates

Filed under: macro housingmortgage

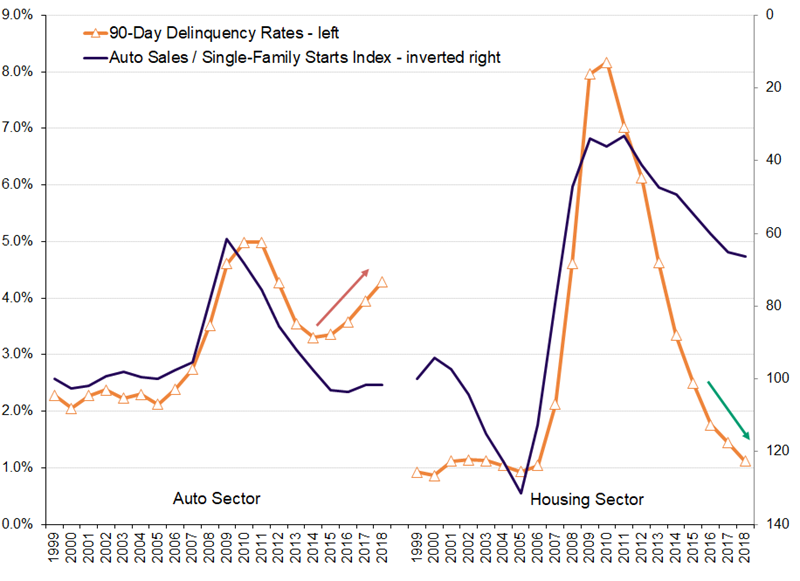

Historically, the housing and auto markets have been highly linked given the big-ticket nature of the consumer purchases and the dependence on credit for the majority of buyers. For example, from 1990-2016, auto sales and housing starts have moved in tandem in 22 out of 26 years. Similarly, from 1999-2013, delinquency rates for the two markets were 98% correlated, essentially both moving in lock-step with the economic cycle. However, in recent years, the markets have been more dissimilar than alike, which we believe has implications of how the relative performance of the two industries evolves moving forward.

According to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit, 90-day delinquency rates as of 4Q18 stood at 4.5% for auto loans and 1.1% for mortgages. While it is not unusual for auto credit performance to be worse than for mortgages, as that was the case every quarter from 1Q99 through 4Q07, the current spread of 340 basis points is the widest in the 20-year history of the data and credit quality has been consistently going in opposite directions since 2014.

We believe that the divergent performance over the last handful of years relates to lenders approaching the auto market more aggressively due to already-elevated production levels versus conservatism in the mortgage market. For instance, in 2012 and 2013, the median credit score on auto originations was approximately 80 basis points below that of mortgages, double the spread from 1999-2007. This relatively weaker credit quality likely filtered into 2014 performance, creating the inflection point between the two data sets.

The deterioration of auto loan quality is atypical given the strength of the economic cycle. Historically, delinquency rates and auto production have been inversely correlated. Thus, when the economy is good, consumers benefit from wage growth and credit expansion, production rises and delinquencies drop. When the economy is poor, the opposite effects take place. Credit quality deteriorating while the economy is strengthening suggests that auto lenders are stretching to find an incremental buyer with industry volumes near peak levels.

This is not happening in the housing market. Delinquency rates declined 30 basis points in 2018 to just 1.1%, slightly above the 1.0% average from 1999-2006. And, importantly, underwriting remains responsible versus history. The median credit score of 706 in 2018 is 24 points higher than was witnessed from 1999-2006 and, as published in our proprietary Mortgage Originator Survey, our 0-100 underwriting criteria index stood at 53.6 in 2018, indicating slightly stricter terms than historical norms.

To be sure, an economic slowdown would bring about weakness for both auto sales and housing demand, but we believe that risk is far more pronounced for the auto industry given near-peak volumes and already-stretched credit metrics. This is in stark contrast to the housing sector where overall supply is abnormally tight, new construction production is still depressed and lenders have yet to test the edges of responsible underwriting, as has been common at the end of prior cycles. Framed differently, we believe housing always has cyclical risk, but the current risk is far less than one would expect after nine years of overall economic expansion.

Friday, March 8, 2019 by Zelman & Associates

Filed under: macro housingmortgage

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey