Single-Family Rental Sector Enjoying Sweet Spot of Growth Amidst Tight Supply

Friday, March 8, 2019 by Zelman & Associates

Filed under: institutional investorssingle-family rental

Public REITs Invitation Homes (INVH) and American Homes 4 Rent (AMH) are the two largest single-family landlords in the country, owning almost 81,000 and 53,000 homes, respectively. While each company controls less than 1% of national single-family rentals, their scale and geographic diversity provide useful perspective on industry trends, complementing our monthly Single-Family Rental Survey of owners and property managers.

For 4Q18, the public REITs reported rent growth on leases signed during the period of 3.5% on a weighted basis, including 3.7% for INVH and 3.2% for AMH. Each company outperformed 4Q17 growth by approximately 20 basis points, marking the first quarter since 4Q16 that year-over-year improvement was recorded. Similarly, as previously reported in our proprietary survey, our estimate of industry-wide rent growth was 3.6% in 4Q18, up 40 basis points year over year, which represents the best comparison since 3Q16.

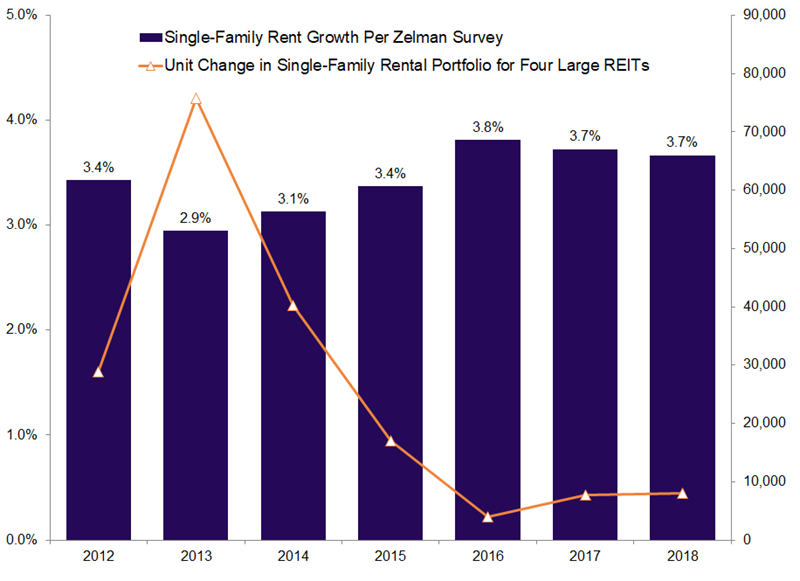

With the fourth quarter strength, 2018 full-year rent growth was equal to 2017, both for the public REITs at 4.1% and our survey respondents at 3.7%. Although comparable disclosures from the public REITs are not available historically, our survey permits this comparison. Based on our data, rent growth from 2016-18 (3.7-3.8%) has been notably stronger than from 2012-15 (2.9-3.4%), which we attribute to an improved economic environment, better entry-level wage growth and rising overall housing occupancy rates.

Additionally, we note that acquisitions by large institutional single-family REITs were more significant during the 2012-15 period as these entities were emerging and focused on building scale. That led to a greater emphasis on occupancy than rent growth, which we believe depressed industry-wide measures. More specifically, the two aforementioned REITs, in addition to Progress Residential and Tricon American Homes owned approximately 180,000 homes at the end of 2018, an increase of almost 8,000 from 2017, similar to the net change in the prior year. This pales in comparison to the peak net additions of 75,500 in 2013 and is 50-80% lower than in 2012, 2014 and 2015. Not surprisingly, there is a strong inverse relationship between rent growth across the industry and the purchasing activity of the largest REITs.

Although REITs beyond these four are acquiring homes at a more rapid pace today, we do not foresee a return to the impact on the broader industry that was evident from 2012-14, which should mean that fundamentals will be more closely tied to job creation and single-family starts. Using our forecasts for AMH and INVH as a proxy for the industry, assuming the macro employment environment remains stable, we expect single-family rent growth to be similar in 2019 (4.2%) as in 2018 (4.1%) as a modest increase in new single-family construction supply and a moderation in home price appreciation is balanced against slightly stronger household formation. For 2020, we expect slight deceleration to 4.0% rent growth as single-family housing starts are expected to increase at a faster pace while demand is assumed to be steady and solid.

Friday, March 8, 2019 by Zelman & Associates

Filed under: institutional investorssingle-family rental

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey