Single-Family Built-to-Rent Likely Here to Stay

Friday, April 19, 2019 by Zelman & Associates

Filed under: homebuildinginstitutional investorssingle-family rental

Every month, we track interest in built-to-rent construction, along with other acquisition channels, in our proprietary survey of single-family rental operators. Over the last year, interest in partnering with homebuilders on built-to-rent projects has increased steadily from both public and private investors. However, the focus on single-family construction built specifically for rent is not new and has been a feature of the post-recession cycle.

While the media focuses on homeownership as a gauge of single-family demand, we believe the total share of households living in single-family housing is a more accurate measure, as it isolates the demand for the lifestyle from how it is financed. This share has remained at 67-69% since 2000, higher than 66% in 1990 and stable-to-slightly higher than 67% in 1980. However, disaggregating this by single-family owned and rented, the share of households renting has increased from 10% to 12% since the peak of the prior cycle in 2007.

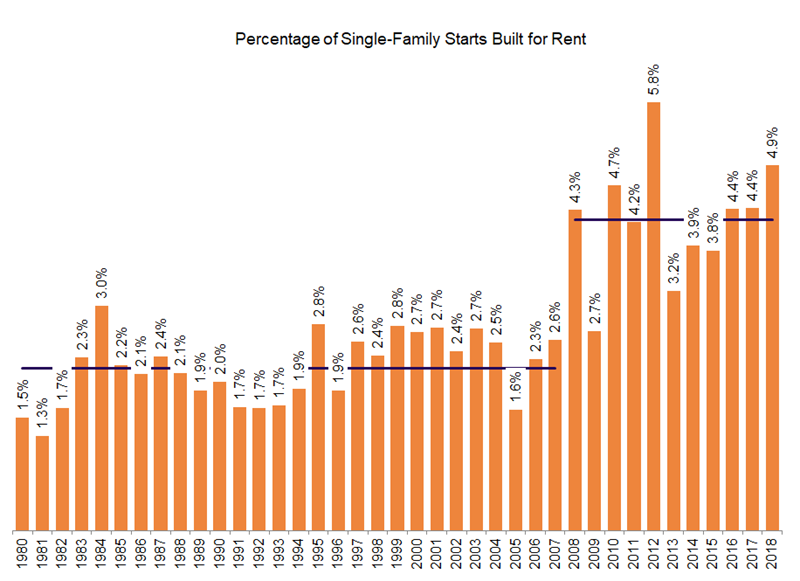

Interestingly, most of the single-family homes rented today were initially constructed for sale, with only 1-3% of single-family starts being built for rent from 1980-2007. Following the downturn, this share has increased steadily, averaging 4% from 2008-18. In absolute terms, the 43,000 single-family units built for rent in 2018 represented the highest level since at least 1980.

In our view, the increased institutionalization of the single-family rental asset class following the Great Recession is likely to result in sustained appetite for built-for-rent construction, driven by investor demand and homebuilder interest in a more stable source of unit volume and cash flow, especially since partnerships between homebuilders and investors offer benefits to both sides.

For example, when a single-family rental investor agrees to purchase newly-built homes from a homebuilder, it provides the latter with the certainty of guaranteed closings and a faster exit from an existing community. A portion of these saved costs are shared with the investor, who benefits from acquiring a new home at a 4-6% discount to retail value. Importantly, the discount to the investor’s own cost to build is likely greater and in the 8-10% range, primarily due to the difficulty of replicating the cost efficiency and timeline of an experienced builder.

The investor also gains the benefit of deploying capital more deliberately and with more intensity in preferred neighborhoods versus one-off acquisitions that are less efficient. Relative to portfolio deals, built-to-rent agreements can provide scale quickly without the hassle of pruning and renovating an acquired portfolio.

Across our universe of industry contacts, we see a variety of strategies being implemented and considered across the spectrum of price points and livable square footage per acre. Investors that prefer the liquidity that comes from being able to sell a home to an owner occupant are likely to prefer built-for-rent product that is largely identical to neighboring owner-occupied homes and comprises a minority percentage of a traditional owner-occupied community. On the other hand, investors with a cash flow yield focus are considering denser, custom-built communities comprised entirely of single-family rental homes with different combinations of outdoor and indoor space and with varying levels of shared amenities.

Friday, April 19, 2019 by Zelman & Associates

Filed under: homebuildinginstitutional investorssingle-family rental

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey