Where are the iBuyers Heading Next?

Friday, April 19, 2019 by Zelman & Associates

Filed under: existing home salesinstitutional investorsreal estate services

In recent years, iBuyers have gained notable attention and become a widespread topic of debate. Effectively the new-age version of “We Buy Ugly Houses”, which has been around since 1989, iBuyers charge sellers 7-10% of their home value in exchange for the “convenience and speed” at which they will purchase the home – providing liquidity to sellers in a matter of days. The intention is to capture a spread upon reselling to the market and to leverage its role in the transaction through affiliated businesses such as mortgage and title. Through partnerships with homebuilders, iBuyers can also facilitate a reduction in contingency sales.

While the long-term risk-reward, profit potential and market valuations of iBuyers will remain debatable, what is not arguable is that significant venture capital is being devoted to the space and a race for scale is emerging.

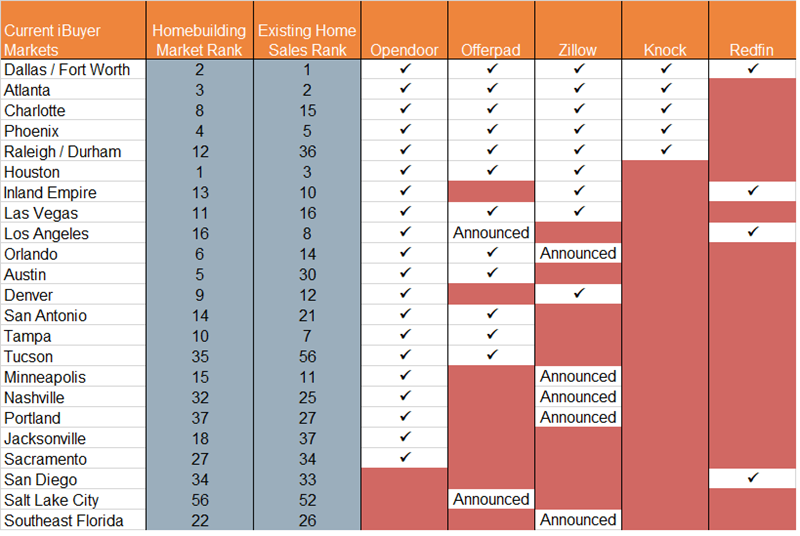

As with all real estate operations, local and smaller-scale players exist, but for simplicity, we focus on the five most recognized multi-market iBuyers – Opendoor, Offerpad, Zillow, Knock and Redfin Now. Currently, Opendoor is available in 20 markets, Offerpad in 12 with two coming soon, Zillow in nine with five more announced, Knock in five and Redfin Now in four.

Though market shares across all locations are not readily available, Phoenix is widely recognized as the largest iBuyer market, where these entities account for roughly 7% of transactions. More simplistically, all five of these iBuyers currently operate in Dallas-Fort Worth, four of the five operate in Atlanta, Charlotte, Phoenix and Raleigh-Durham, and three of the five are available in Houston, the Inland Empire and Las Vegas. In total, these iBuyers operate in 21 markets, with two more “coming soon.”

For perspective on the capital entering the fray, Opendoor, the largest and fastest growing player, has raised $1.3 billion of equity and secured more than $3 billion of debt. Offerpad has raised close to $1 billion between equity and debt, Knock has raised around $600 million, and Zillow has secured two credit agreements totaling $1 billion of debt availability and is targeting roughly 15% of its iBuyer capital to be from its own equity, bringing its current capital availability to roughly $1.2 billion.

To frame the current capital devoted to the iBuyer model across these companies, assuming the capital is turned four times a year, they could theoretically aggregate mid-to-high single digit market share across the 23 markets they are currently active in or have announced intentions to enter.

Notably, while scale and aspirations of widespread geographic penetration is a common theme for these companies, led by Opendoor’s 20-market footprint, the early path of market selection has been fairly predictable – high volume geographies where getting pricing right is the easiest. Simply put, the more homogenous a market’s housing stock, the easier it is for an algorithm to accurately price the bid, renovations and potential sale price; the more unique and heterogeneous, the more difficult.

As such, there is a high correlation between iBuyer markets and where production homebuilders are most prevalent. Pricing a 2,400 square foot house built in 2004 in a 200-homesite community in Phoenix is much simpler and more transparent than pricing a 2,400 square foot house built in 1920 in Boston. To this point, we compare the iBuyer markets not only to resale markets with the most transactions, but to the most important homebuilding markets. Charlotte and Raleigh, which have four of the five iBuyers, are good examples where they rank as the 15th and 36th largest resale markets, but more importantly the 8th and 12th most significant homebuilding markets.

Looking forward, iBuyers will likely continue gravitating to similar locations. For top markets that check the boxes as important resale and homebuilding areas, we believe Washington D.C., Chicago, Indianapolis, Philadelphia, Baltimore, Columbus and Sarasota are likely choices for expansion.

Friday, April 19, 2019 by Zelman & Associates

Filed under: existing home salesinstitutional investorsreal estate services

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey