As Housing Sentiment and Actions Often Contradict, What Factors Matter Most?

Friday, May 17, 2019 by Zelman & Associates

Filed under: macro housingmortgage rates

Last week, Fannie Mae released the results of its monthly Home Purchase Sentiment Index, which is “designed to track consumers’ housing-related attitudes, intentions and perceptions.” As a research firm, we always find value in surveys, assuming that the sampling and weighting methodologies are sound to ensure a representative output, as we believe they are in the Fannie Mae survey. However, a factually correct survey does not necessarily mean that it is predictive. In our experience, this is particularly true for sentiment-based questions as consumers do not always act as they say.

Specific to the Fannie Mae survey, respondents are asked to qualify whether it is a good or bad time to buy, a good or bad time to sell; their outlook for home prices and mortgage rates; the trend in their own financial circumstances; mortgage availability; and the health of the economy. Although all of these factors should be extremely relevant to homebuying activity, to quantify the connection, we compare historical results to the year-over-year change in homebuilder orders, as tracked by our proprietary monthly survey and public builder financial results.

To say that any factor in isolation can be confusing is an understatement. For instance, in 3Q10, 68% of respondents deemed it a “good time to buy” but homebuilder orders were down 24% year over year. In 1Q15, the “good time to buy” share was similar at 67%, but homebuilder orders were up 22% year over year. In 1Q19, 63% of respondents said it was a “good time to sell” but the share expecting prices to rise further over the next year outnumbered those anticipating a decline by 5 to 1.

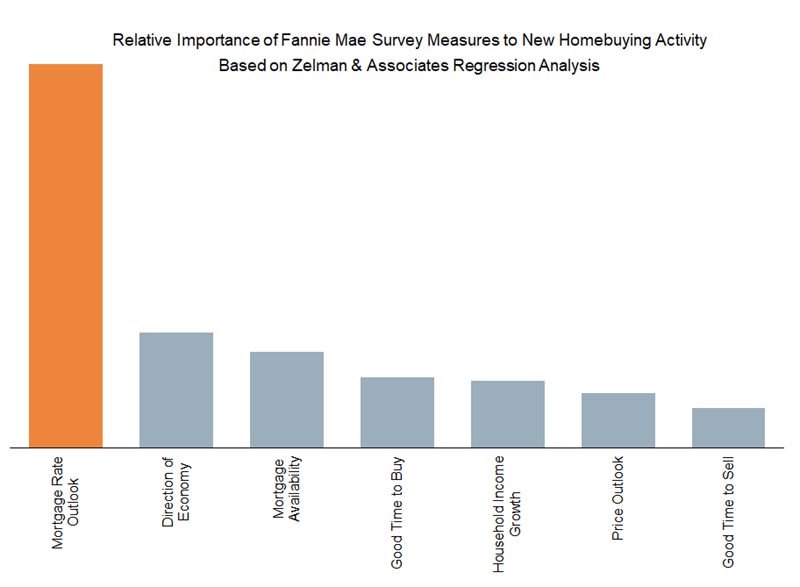

To sort through the various feedback, we ran a simple regression analysis of seven Fannie Mae variables against our measure of homebuilder orders, covering 29 quarters from 1Q12-1Q19. In layman’s terms, the regression highlights what has aligned most and least with actual behavior. We show that this relative importance is dominated by the mortgage rate outlook of respondents. This is over three times as relevant as the direction of the economy, which ranked second, followed by mortgage availability in third.

Whether or not it was a “good time to sell” was relegated to last place out of our seven measures, heavily discounting the usefulness of that feedback in understanding homebuying demand. The outlook for home prices surprisingly registered second to last in relevance, which we attribute to the bifurcated impact of home price appreciation. If home prices rise too quickly, entry-level buyers’ affordability and confidence is damaged, but minimal home price appreciation or home price deflation undermines existing owners’ confidence and lessens urgency to act.

In April, 46% of Fannie Mae survey respondents expect mortgage rates to increase over the next year, the lowest share since August 2016. Meanwhile, the share deeming it a “good time to buy” was just 53% in April, near the 52-53% cycle trough. Our analysis strongly suggests that the effect of lower rates is going to win that perceived conflict.

Friday, May 17, 2019 by Zelman & Associates

Filed under: macro housingmortgage rates

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey