Income Analysis Suggests Future Firepower for Homeownership

Friday, May 3, 2019 by Zelman & Associates

Filed under: demographicshomeownership

For 1Q19, the Census Bureau’s Housing Vacancy and Homeownership Survey (HVS) estimated the national homeownership rate at 64.2%, unchanged from 1Q18. This is the first time out of the last eight quarters that homeownership did not increase on a year-over-year basis. Although very weak housing transaction activity and confidence in 4Q18 likely filtered into the 1Q19 data, it is interesting to note that households with below-median income reportedly witnessed a 50 basis point improvement in homeownership versus a 30 basis point contraction for above-median income households.

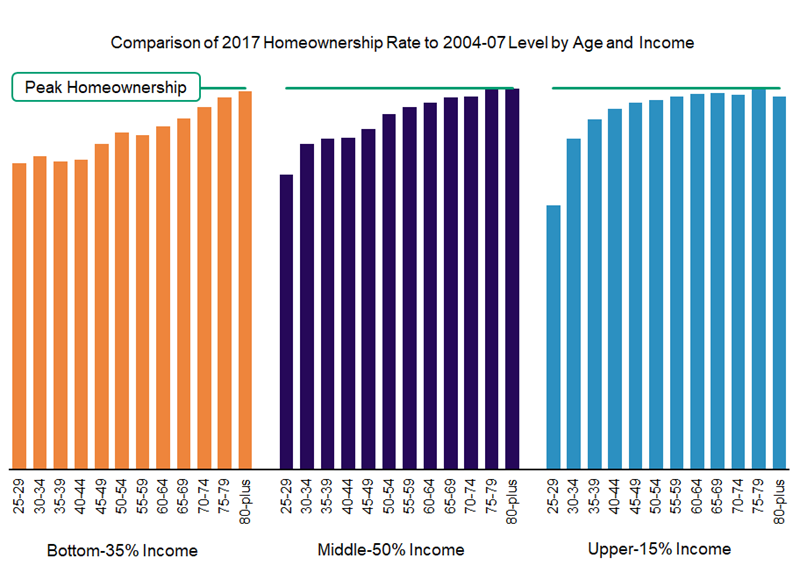

This led us to wonder how the latest homeownership statistics compared to recent history. To most accurately assess, we utilized more granular data from the American Community Survey (ACS) across age-cohorts and income profiles. For income, each year we segmented the bottom 35%, middle 50% and top 15% of earners. By isolating two of the most relevant factors behind homeownership (age and income), we can better identify the future potential as family circumstances and lingering cyclical effects from the Great Recession even out.

In 2017, which is the latest ACS data available, the national homeownership rate of 64% was comprised of roughly 46% for the bottom-35% of income, 70% for the middle-50% and 86% for the top-15%. Adjusting for the shifting mix of age cohorts over time, the national homeownership rate in 2017 stood at 92% of the average from 2004-07. Not surprisingly, the lower-income cohort was worst at 91% of the prior peak level, but the middle-income cohort was not much better, at 92%. With greater financial flexibility, ownership for the upper-income cohort was 95% of the prior peak level.

Segmenting further by age, it is apparent that older households were significantly less effected by the crisis, with 2017 ownership equal to 97-100% of the peak for 11 out of the 15 groupings at least 60 years of age. Meanwhile, the greatest differential resides in the youngest cohorts, which is true across income profiles.

Interestingly, 25-29 year olds in the top-15% of household income had the biggest shortfall to peak ownership, even more so than middle and bottom income peers. Given that we can largely rule out a lack of affordability for the discrepancy at higher income levels, it more likely speaks to demographic shifts as these individuals are far less likely to be married, have children and need incremental space versus a decade ago. Specifically, across all 25-29 year old households, the married share was 33% in 2017 versus 41% in 2004. The share with children declined to 38% from 47% in 2004. While it is taking longer for young adults to reach these milestones, as they increasingly catch up for time lost overlapping the Great Recession, we anticipate that homeownership trends will follow.

Friday, May 3, 2019 by Zelman & Associates

Filed under: demographicshomeownership

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey