Alarming Increase in Mortgage Debt-to-Income Ratios Reverses Course

Friday, July 26, 2019 by Zelman & Associates

Filed under: affordabilitymortgage

Late last year, the average mortgage debt accumulated by homebuyers relative to their income was quickly rising, which was attributable to home price appreciation outpacing income growth, spiking mortgage rates and more lenient underwriting programs by Fannie Mae and Freddie Mac. Naturally, this was sounding alarm bells about entry-level homebuyer affordability and the responsible sustainability of the housing recovery.

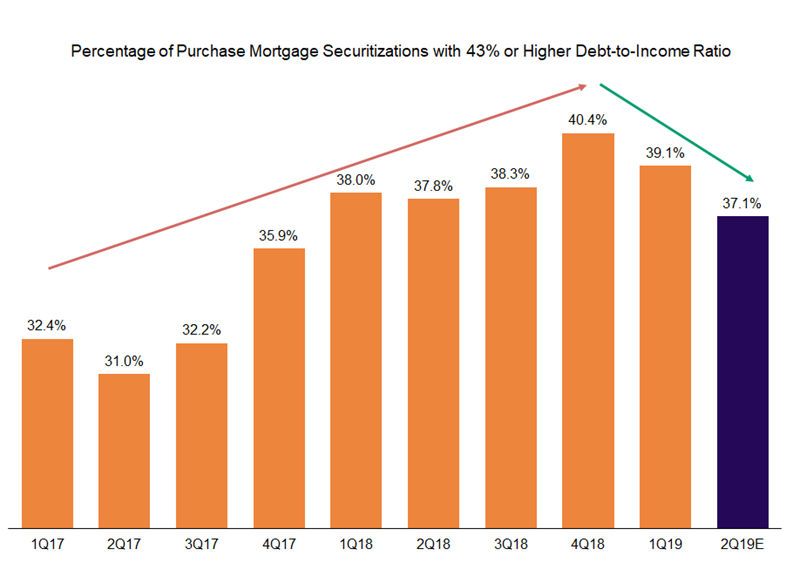

For instance, in 4Q18, 40.4% of purchase mortgages securitized by Fannie Mae, Freddie Mac and Ginnie Mae had a debt-to-income (DTI) ratio of 43% or higher, which the Consumer Financial Protection Bureau deemed a target threshold within its ability-to-repay legislation. This share was up 210 basis points from 3Q18 and 450 basis points from 4Q17. Put differently, for all of 2018, high-DTI securitized purchase mortgages increased 16% year over year versus a 10% decline for those below the threshold.

However, our analysis of securitization data so far in 2019 reveals that this trend has reversed course and fewer homebuyers are falling in the high-DTI classification. In 1Q19, 39.1% of purchase mortgages had a 43% DTI or higher, a 130 basis point decline from 4Q18. Of note, the high-DTI share increased 200-220 basis points sequentially in the first quarter the prior two years, so the improvement in 1Q19 was far in excess of normal seasonality.

Full mortgage securitization data is not yet available for June, but our analysis indicates that additional improvement has been notched thus far in 2Q19. In April, the high-DTI share was down 50 basis points year over year, the first such decline since February 2015. This improving trend accelerated in May, down 100 basis points year over year. In total, we estimate that the high-DTI share will average 37.1% in 2Q19, down 70 basis points year over year and 320 basis points improved from the 4Q18 peak.

Like last year, mortgage rates are the primary story behind the shift in leverage. In 2Q19, the average 30-year fixed mortgage rate averaged approximately 4.10%, down almost 70 basis points from the 4Q18 average. However, this does not mean to imply that mortgage rates are the only reason for the upward pressure on DTI ratios. Consider that the 2Q19 mortgage rate was similar to 1Q17, but the share of high-DTI loans was up 480 basis points given faster home price appreciation than income growth.

Given the extended economic cycle and housing recovery, it stands to reason that DTI ratios would be closer to a peak than a floor. Nevertheless, it is encouraging that consumers and lenders are transferring the reduction in mortgage rates to lower leverage rather than more expensive homes.

Friday, July 26, 2019 by Zelman & Associates

Filed under: affordabilitymortgage

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey