The Latest on Homeownership and Housing Supply

Friday, July 26, 2019 by Zelman & Associates

Filed under: homeownershipmacro housing

Yesterday, the Census Bureau released its quarterly Housing Vacancy Survey (HVS), which is intended to measure the occupancy and ownership status of the nation’s housing stock. Although the second quarter release indicated a sequential decline in the homeownership rate and rising vacancy rates, we take a more positive stance after analyzing the underlying data.

According to the government survey, the national homeownership rate was 64.1% in 2Q19, down 10 basis points sequentially and 20 basis points year over year. Although small changes in the ownership rate could be attributed to statistical noise, the year-over-year decrease was the first since 4Q16 so it deserves attention.

Across 12 major age cohorts, only two witnessed higher homeownership rates in 2Q19 than 2Q18: 25-29 year olds (up 10 basis points) and 70-74 year olds (up 80 basis points). That is the weakest breadth since 2Q15. Of note, black households’ homeownership rate of 40.6% declined 100 basis points from 2Q18. This was not only the largest decline for the major races, it also represented a 25-plus year low.

Fortunately, we expect better metrics around the corner. Despite the recent moderation, over the last three years, a 120 basis point increase in the homeownership rate was carried by young adults, particularly the 25-29 (290 basis points) and 30-34 (270 basis points) age cohorts. These traditional entry-level buyers were undoubtedly most affected by the spike in mortgage rates last year, which we believe filtered into reported homeownership stats so far in 2019.

However, robust growth in the entry-level price point of late should translate to a reacceleration in homeownership rates moving forward. For instance, based on our proprietary Homebuilding Survey and public builder disclosures, we estimate 2Q19 homebuilding absorption rates were up 4-5% year over year, led by a strong double-digit increase for entry-level communities.

Separately, the government release estimated the national housing vacancy rate at 12.2% in 2Q19, higher than the prior two quarters. We believe that the HVS overstates national vacancies as it has not correlated to the broader Decennial Census in the past, and it also contradicts our fundamental research.

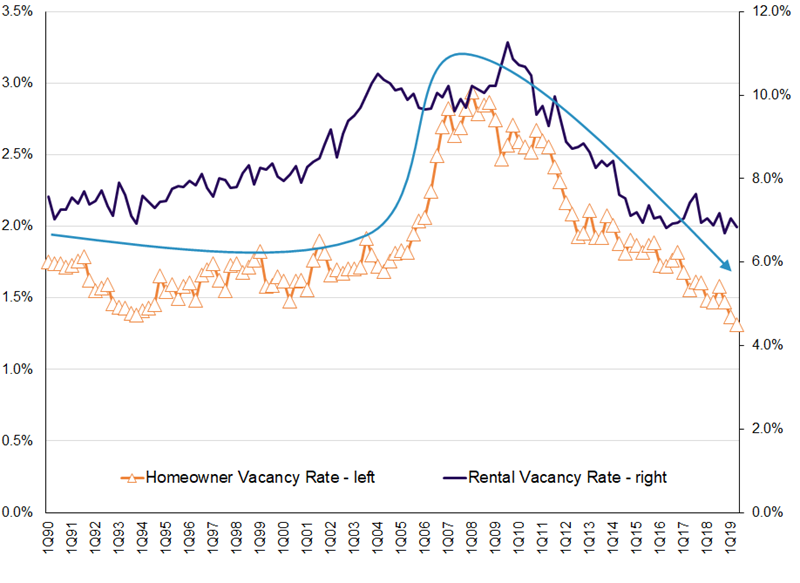

That said, focusing only on the more-easily tracked for-sale and for-rent categories of vacant homes highlights very tight supply. The homeowner vacancy rate of 1.3% was down year over year for the 15th consecutive quarter and is at the lowest rate since at least the 1980s. Similarly, the rental vacancy rate of 6.8% was the third lowest over this time period.

Even though we do not have the highest of confidence in the government’s data, we do believe that improving demand led by a 120 basis point reduction in the 30-year fixed mortgage rate since last November and extremely tight supply conditions as detailed above have combined to put entry-level homebuilders and home sellers in a very enviable position.

Friday, July 26, 2019 by Zelman & Associates

Filed under: homeownershipmacro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey