Residential Construction Warning of Nearing Recession?

Friday, August 23, 2019 by Zelman & Associates

Filed under: apartmentshomebuildingmacro housing

Through the first seven months of 2019, residential construction for single-family and multi-family projects has trailed the prior-year period across the board. Specifically, single-family permits and starts are both down 3% while multi-family permits are down 2% and starts are down 5%. Although we do not specifically forecast permits, these low single-digit declines for starts are trailing our growth forecasts of similar magnitude.

We still believe there is a reasonable path for housing starts to rebound before year end by enough to flip the script to growth given strengthening order demand for single-family new construction and robust appetite among developers on the multi-family side of the channel.

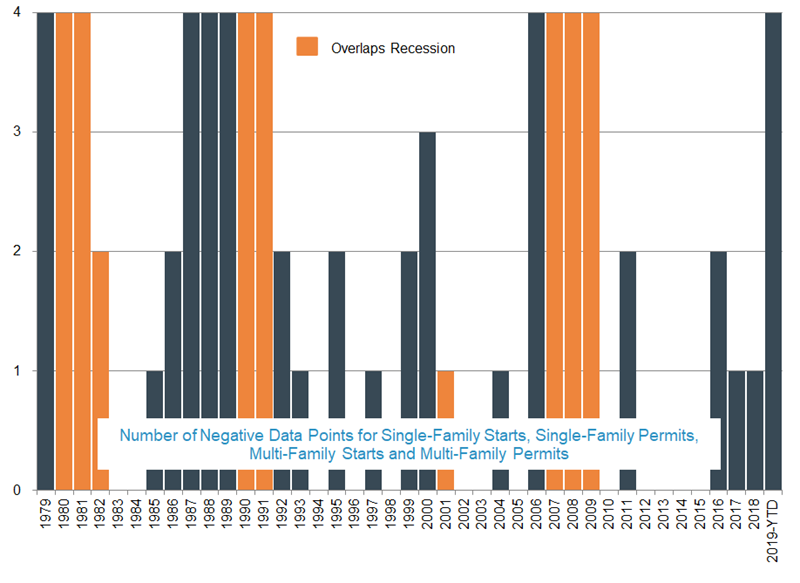

However, if we are wrong and the declines persist for the entire year, it could be an ominous signal for the broader economy. Consider that last cycle, the market first flipped from broad-based growth to broad-based contraction in 2006, a year before the official economic recession began, and this lasted through 2009. This similarly happened in 1979 before the 1980-82 recession. The lead time was a bit longer ahead of the 1990-91 recession, with all four pieces of the market declining in 1987, 1988 and 1989 before the official downturn set in. Around the 2001 recession, broad-based declines were avoided entirely.

So in summary, there have been three previous periods when single-family and multi-family permits and starts all declined in the same year, and in all three instances a recession started within 1-3 years. To be sure, the difference between one year and three years is significant, so it is not overly predictive. Furthermore, the average declines in 1979 (13%), 1987 (14%) and 2006 (10%) were more substantial than the modest declines unfolding this year and even greater in the subsequent year, which we would argue was a catalyst for the recession rather than a by-product of it.

Overall, we believe that the market will be pleasantly surprised by stronger macro residential construction data over the last five months of the year, lessening the risk of broad-based declines this year and resulting in greater confidence in the cycle heading into 2020. If we are right, it’d be in support of a no-recession scenario next year.

Friday, August 23, 2019 by Zelman & Associates

Filed under: apartmentshomebuildingmacro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey