Contrary to Perception, Little Difference Between Young and Old DTI Ratios

Friday, September 6, 2019 by Zelman & Associates

Filed under: affordabilitymortgage

Earlier this week, Home Mortgage Disclosure Act (HMDA) data for 2018 was released. The annual dataset is enormous and serves as the primary baseline for most analyses of the mortgage market and its participants. This year also includes numerous incremental data fields as regulators aim to improve mortgage lending disclosure and transparency.

The age of the primary borrower and the debt-to-income (DTI) ratio, inclusive of all non-housing debt, are two of these new fields. Although DTI is only one of many variables used by mortgage underwriters, with it determining the threshold between a Qualified Mortgage (QM) and one that carries higher risk to the originator, it is of heightened focus today. In many ways, the 43% DTI breakpoint is unfairly being interpreted as the difference between good and bad credit.

However, as we first argued in November 2018, utilizing DTI ratios in isolation to assess affordability and credit risk can be incredibly misleading. To prove this point further, we segment 2018 purchase mortgage originations by age of the borrower. While many market observers would likely assume that DTI ratios are higher for younger borrowers that typically have less income and are more likely to carry student loans and credit card debt, we find that this is not necessarily the case.

For perspective, 87% of mortgaged home purchases in 2018 were by buyers 25-64 years old. We segment these ages into four cohorts (25-34, 35-44, 45-54 and 55-64). Among these homebuyers, 71% utilized a conventional mortgage, followed by 18% backed by the FHA, 9% through the VA and 2% via other government programs.

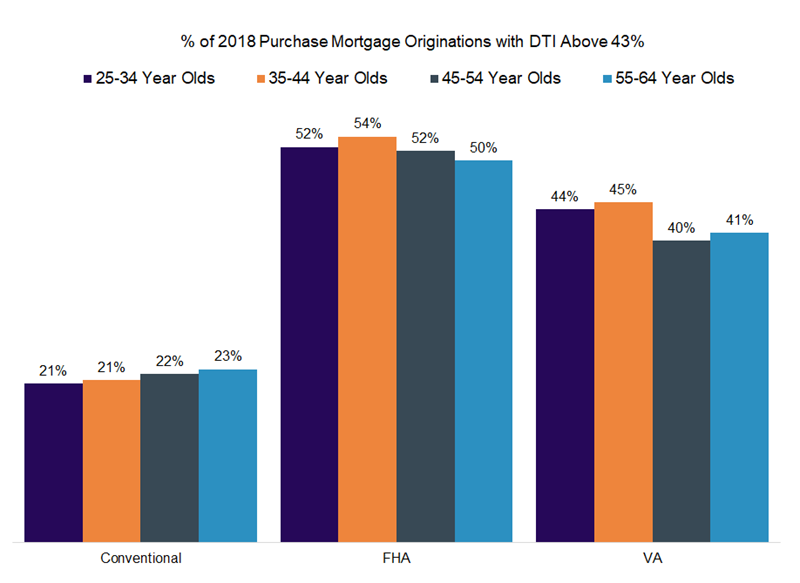

Looking first at conventional loans that account for the vast majority of the market, 21% of borrowers aged 25-34 had a DTI ratio above 43%, the same as for 35-44 year olds, but marginally below 22% for 45-54 year olds and 23% for 55-64 year olds. For FHA loans that permit higher leverage, 52% of 25-34 year old borrowers exceeded the 43% threshold, lower than for 35-44 year olds (54%), but marginally higher than for the older cohorts. Lastly, for VA loans, younger borrowers are more likely to exceed a 43% DTI than older borrowers.

Overall, there is very little correlation between the age of a homebuyer using a mortgage and their DTI ratio. Said differently, young homebuyers are heavily skewed to the first-time buyer segment, typically have a less established balance sheet and are on the early side of their income potential, but they are not stretching any more or less than older cohorts that many would deem to be safer credits, on average. We believe that this is an important point given the housing market’s dependence on a strong entry-level segment, which is dominated by younger buyers.

Friday, September 6, 2019 by Zelman & Associates

Filed under: affordabilitymortgage

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey