Continuing Streak, Housing Stocks Big Winners Again in Third Quarter

Friday, October 4, 2019 by Zelman & Associates

Filed under: stocks

Our firm produces stock price indices for eight sectors where we provide equity research coverage, presently capturing roughly 80 companies and almost $800 billion of market capitalization. In 3Q19, the S&P 500 increased 1.7%, following a 4.3% gain in 2Q19 and a 13.6% return in 1Q19. Of note, the 10-year Treasury yield compressed 32 basis points in the third quarter, marking the fourth consecutive sequential quarterly decline, which had not happened since 1Q15.

In the third quarter, six out of eight housing-related sectors outperformed the broader market led by homebuilders (up 18.5%), the homecenters (up 11.5%), apartment REITs (up 10.1%), title insurers (up 9.9%) and single-family REITs (up 9.3%). Only real estate services (down 21.3%) and mortgage insurers (down 1.5%) underperformed while the gain was more moderate for building products (up 3.0%). Our composite index, inclusive of each of the aforementioned sectors, returned 7.1% in 3Q19, or 540 basis points ahead of the S&P 500, which was the best since 1Q15.

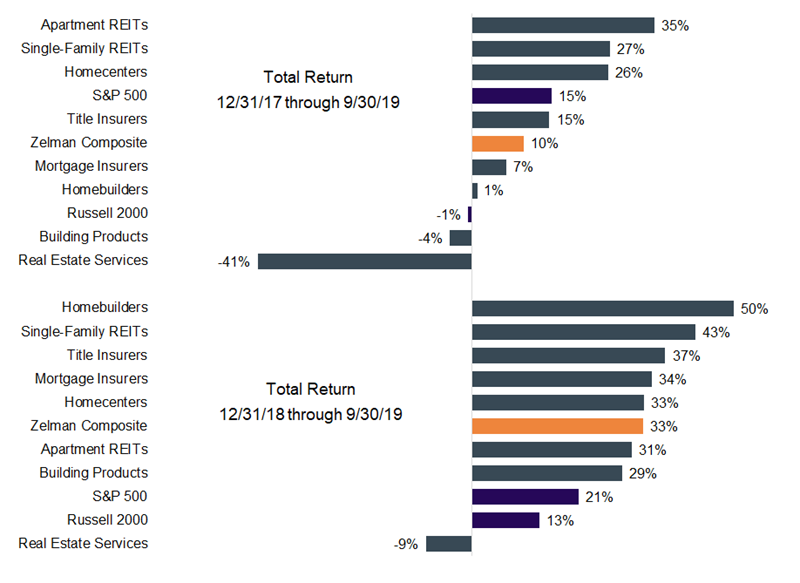

Similar to 3Q19, year-to-date sector performance through September was almost universally robust for housing-related equities. Our composite index returned 32.8%, or 1,230 basis points ahead of the S&P 500, representing the strongest three-quarter start to a year since 2012.

By sector, year-to-date strength was led by homebuilders (up 50%), single-family REITs (up 43%), title insurers (up 37%), mortgage insurers (up 34%) and homecenters (up 33%). Building products (up 29%) also outperformed the S&P 500, while only real estate services (down 9%) underperformed.

While these gains are impressive and reflect substantial improvement in housing fundamentals throughout 2019, it is important to caveat the results against significant underperformance for housing-related stocks in 2018.

Looking at returns since the end of 2017 results in a more varied picture. Versus a 15% return for the S&P 500, apartment REITs (up 35%), single-family REITs (up 27%) and homecenters (up 26%) were clear outperformers. Title insurers (up 15%) matched the broader market return, while mortgage insurers (up 7%), homebuilders (up 1%), building products (down 4%) and real estate services (down 41%) trailed.

Friday, October 4, 2019 by Zelman & Associates

Filed under: stocks

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey