Data Conflict With Single-Family Rental Bull Thesis

Friday, October 18, 2019 by Zelman & Associates

Filed under: homeownershipsingle-family rental

We have always been of the opinion that the type of housing demanded by consumers is heavily dependent on demographic circumstances and life events. In general, single-family housing skews to families and suburban living while multi-family more directly aligns with those living alone or with roommates in urban settings. Secondarily, whether these homes are owned or rented is driven most directly by financial circumstances.

With this backdrop, we believe it is most informative to analyze the homeownership rate within an asset class, particularly for single-family housing where there is a growing perception that consumer preferences and a lack of affordability are skewing demand toward rentals. In fact, the data reveal an exact opposite trend.

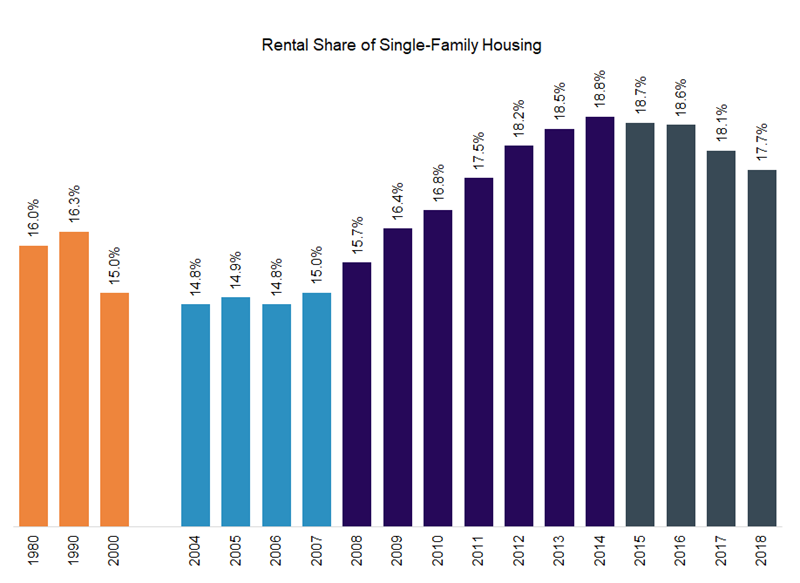

Although single-family rental homes have gained increased media attention over the last handful of years given the emergence of institutional capital in the sector, their importance to demand is not new. For instance, the rental share of single-family homes was approximately 16% in 1980 and 1990 before dropping to 15% in the early part of last decade when loose mortgage lending standards took hold.

According to Census Bureau data, the rental share troughed in 2004-06 at 14.8-14.9%. That figure then climbed continuously alongside the Great Recession and foreclosure crisis, eventually reaching 18.8% by 2014. Said differently, from 2004-14, the number of single-family rental households increased 37% versus just 3% for single-family owned households.

However, this trend has been unwinding since. Based on just-released data, the single-family rental share was 17.7% in 2018, marking the fourth consecutive annual decline, with the largest decreases occurring in the last two years. Although still higher than history, the single-family rental share stood at the lowest level since 2011. In unit terms, single-family rental households have contracted by 2% since 2014 while single-family owned households have expanded by 6%.

Looking forward, we doubt that the rental share of single-family housing will return to the sub-15.0% level without similarly excessive mortgage credit that was pervasive at that time. Nevertheless, we would not be surprised to see a gradual decline in the share back to the 16-16.5% range from the 1980s and 1990s, which would also be consistent with 2009’s share. To be clear, single-family new construction demand will benefit directly or indirectly whether consumer preferences skew toward homeownership or renting. But, the distinction is necessary for those arguing against the desire or ability of consumers to pursue the “American Dream” of homeownership.

Friday, October 18, 2019 by Zelman & Associates

Filed under: homeownershipsingle-family rental

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey