Young Adults Living at Home Still Stuck Near Record Highs

Friday, October 4, 2019 by Zelman & Associates

Filed under: demographicsmillennials

A central theme of the current housing recovery has been an elevated share of young adults living at home with their parents or grandparents, which has hindered household formation and downstream housing demand. According to the latest Annual Supplement to the Current Population Survey (CPS) published by the Census Bureau, this remained a headwind in the most recent year.

Specifically, the CPS data reveal that 33.4% of 18-34 year olds lived at home in 2018, down 30 basis points from 2017, but within the 33.3-34.0% range over the past six years. To best frame this against historical levels, we standardize the CPS data for any changes in methodology and also hold steady the distribution of 18-19, 20-24, 25-29 and 30-34 year olds within the broader age range.

Per our refined dataset, 33.6% of 18-34 year olds lived at home in 2018, steady with 2017 and 2015, which have been the highest readings since 1970. The 32.6-33.6% range from 2010-18 compares to a 30.0% average in the 1990s and 29.3% from 2000-09. We attribute the elevated levels to lingering effects from the Great Recession, continued delays in marriage and having children, rising college participation rates and other socioeconomic dynamics that are more difficult to quantify.

Excluding young adults in high school or attending college, the share at home compressed to 18.5% for 2018, down slightly from 18.6% in 2017, albeit still the second highest level over the last 25 years at least. We focus on this measure more than the total share of young adults at home as we believe it is a better indication of behavioral shifts and financial circumstances.

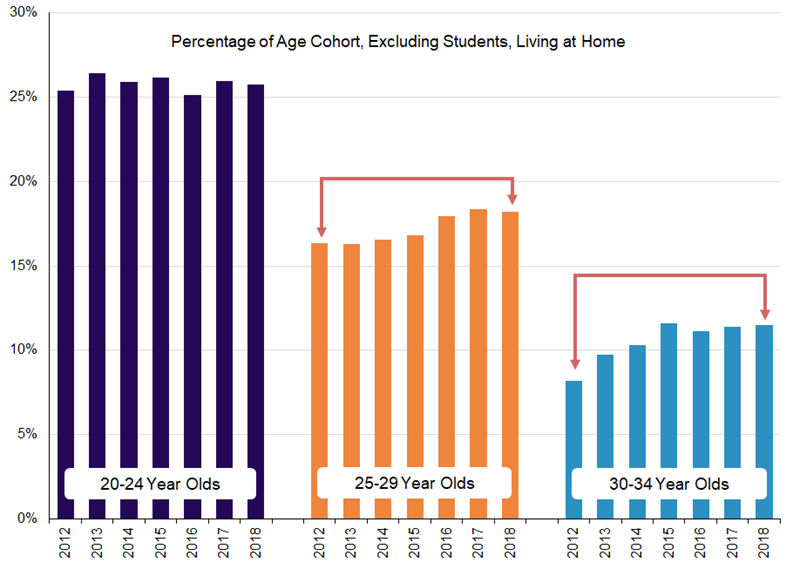

On this adjusted basis, the 18.5% share of 18-34 year olds living at home is comprised of 19.1% for 18-19 year olds, 25.8% for 20-24 year olds, 18.2% for 25-29 year olds and 11.5% for 30-34 year olds. In aggregate, the share at home increased 160 basis points from 2012, the first year of the housing recovery. Importantly, this increase has been entirely driven by the older end of this spectrum.

Relative to 2012, the share of 18-19 year olds at home moderated by 20 basis points and was generally steady over the period. Similarly, the share of 20-24 year olds at home was up just 40 basis points from 2012 and the last three years have been lower than the preceding three years.

The opposite is true for 25-34 year olds that were most negatively affected by the Great Recession. For the 25-29 year old age cohort, 2018 was 190 basis points higher than 2012 while 2016-18 (18.2%) was notably higher than for 2013-15 (16.6%). The most dramatic escalation has been posted by 30-34 year olds, where the 2018 share at home was 330 basis points higher than in 2012 and the last three years have been nearly 60% higher than pre-recession levels.

While we are encouraged by stable-to-improving ratios for young adults that came of age after the Great Recession, we believe it is prudent to take a conservative stance for the cohorts most directly affected by the deep economic downturn, which is likely to alter housing demand versus historical norms for the foreseeable future.

Friday, October 4, 2019 by Zelman & Associates

Filed under: demographicsmillennials

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey