Across-the-Board Upside for Public Homebuilder Third Quarter Key Metrics

Friday, November 15, 2019 by Zelman & Associates

Filed under: homebuildingstocks

Although the industry is still digesting the filter-through effect of weak housing demand from the second half of last year, with homebuilding operating profit down 3% year over year in 3Q19, all key metrics were ahead of our outlook and leading indicators bode well for 2020.

Specifically, closings increased 7% versus our 5% estimate; average closing price was down 3% due to mix caused by entry-level strength versus our down 4% forecast; and gross margin was down 60 basis points year over year, but 40 basis points above our projection.

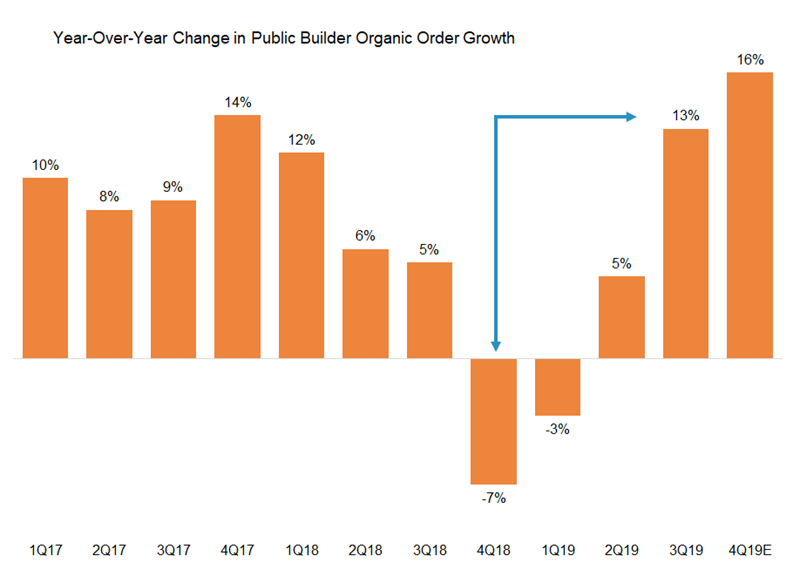

Unit new orders increased a robust 16%, slightly ahead of our estimate at 15%. Excluding the benefit of acquisitions, order growth registered 13%, accelerating from 5% growth in 2Q19 and representing the strongest increase since 4Q17. In fact, the approximate 800 basis points of sequential acceleration matches the momentum in 2Q19, which rank third and fourth strongest out of the 31 quarters since 2011, trailing only 3Q14 and 1Q12.

Friday, November 15, 2019 by Zelman & Associates

Filed under: homebuildingstocks

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey