Public Apartment REITs Post Solid Growth, but Monitoring Signs of Moderation

Friday, November 15, 2019 by Zelman & Associates

Filed under: apartmentsstocks

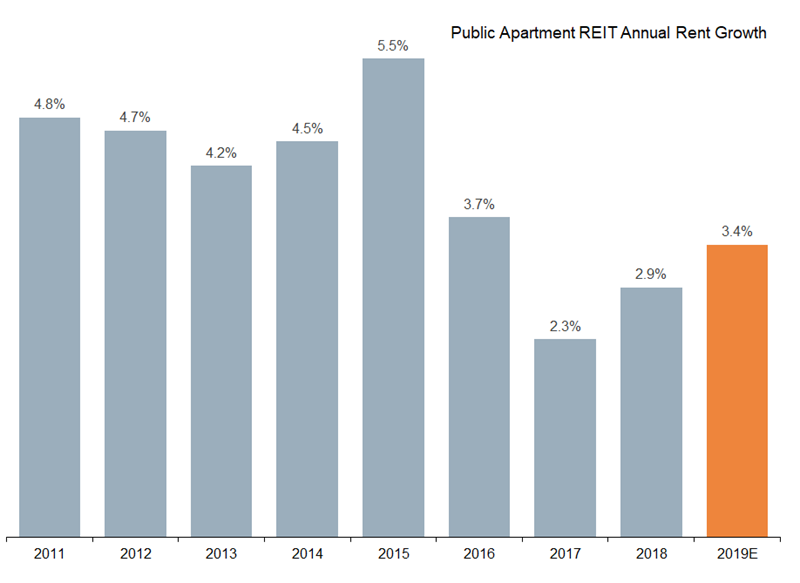

Growth still trails the 2011-16 early-cycle average of 4.9% that spanned from 4.4% in 2014 to 5.6% in 2012. Although the employment environment remains highly supportive of household formation and multi-family demand, an excessive supply backlog remains a headwind.

Focusing strictly on leases that were signed during the third quarter suggests that apartment operators maintain solid pricing power, but their leverage is fading. Rents on renewal leases increased 5.1% year over year in 3Q19, better than 4.8% in the year-ago period, but it was down from 5.3% in 2Q19, the first sequential moderation since 4Q17. Similarly, rents on replacement leases increased 2.2%, still ten basis points higher than in 3Q18, but this compares to year-over-year improvement of 90 basis points in 2Q19, 130 basis points in 1Q19 and 150 basis points in 4Q18.

We forecast total rent growth of 3.4% in 2019 after a 2.9% increase in 2018. Although this is solid in absolute terms, it will likely mark the third consecutive year that growth modestly trailed wage growth for production and non-supervisory workers, which we believe is indicative of late-cycle dynamics.

Friday, November 15, 2019 by Zelman & Associates

Filed under: apartmentsstocks

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey