What Might Plunge in Multi-Family Operator Sentiment Mean?

Thursday, April 23, 2020 by Zelman & Associates

Filed under: apartmentssurvey

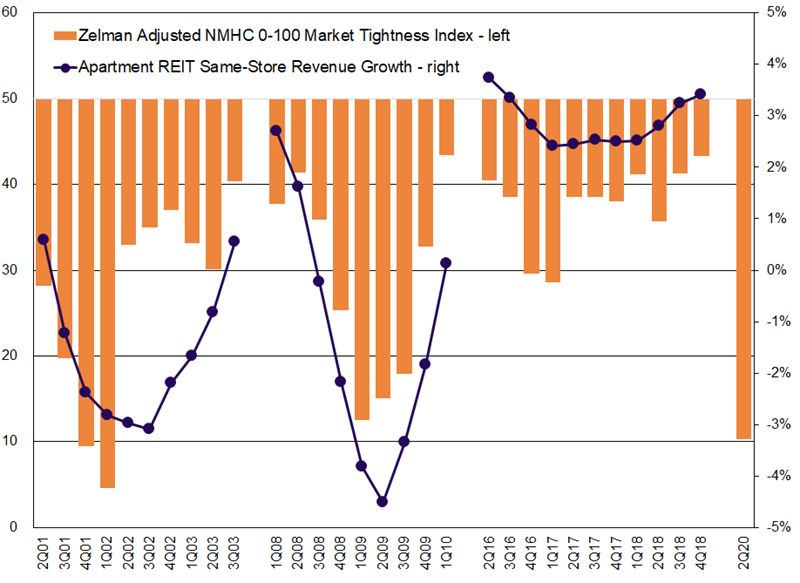

When asked about local market conditions, the NMHC classifies a “tight” market as one with low vacancies and high rent increases. Only 5% of participants responded in this positive manner, the lowest level since 3Q09. Conversely, 82% of respondents offered a more negative perspective. To best summarize this feedback, we calculate a 0-100 index on a seasonally-adjusted basis. This quarter equaled just 10, placing it as the third weakest historical reading since the data began in 3Q99, ahead of only 1Q02 (5) and 4Q01 (10).

Notably, the NMHC data has historically served as a relatively strong leading indicator for same-store revenue growth for the public apartment REITs. In order to ascertain what the latest plunge in the NMHC data might mean for near-term REIT results, we isolate the last three sustained drops in our summary index below the key 50-point threshold, including from 2Q01-3Q03, 1Q08-1Q10 and 2Q16-4Q18. In the first period, lagged same-store revenue growth was negative 1.6%, on average, with the worst quarterly result in 1Q03 at down 3.1%. During the Great Recession, lagged same-store revenue declined 1.3% year over year on average, with 4Q09 the worst quarter at down 4.5%. The most recent period was far more positive, with average same-store sales growth of 2.9%.

Unlike from 2Q01-3Q03 and 1Q08-1Q10 when the quarterly unemployment rate peaked at 6.1% and 9.9%, respectively, the 2Q16-4Q18 period was supported by still-strong employment measures. Given the massive disruption caused by COVID-19, even after stay-at-home orders are lifted and re-hiring actions take place, the unemployment rate is still forecasted to end 2020 in the 9-10% range based on economists’ current outlook. Compounded by excess supply, multi-family operators could face a fundamental backdrop over the next 4-6 quarters that is more challenging that any of these prior examples.

Thursday, April 23, 2020 by Zelman & Associates

Filed under: apartmentssurvey

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey