Unemployment Not a Problem in For-Sale Market - Too Good To Be True?

Friday, June 19, 2020 by Zelman & Associates

Filed under: demographicsmacro housing

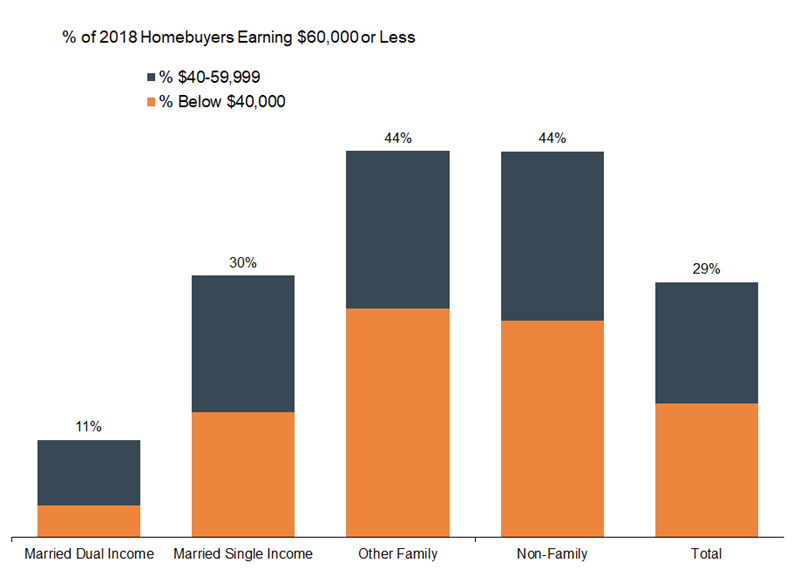

Consider that in 2018, which is the most recent data available, 42% of homebuyers did not have a college degree. In other words, their highest level of educational attainment was a high school diploma or less. We believe that this is far higher than perceived. The remainder of homebuyers have an associate’s degree (10%), bachelor’s degree (28%) or graduate degree (20%). Similarly, while the average household income of all homebuyers was a healthy $110,500, this overlooks the importance of the income distribution, as 19% of homebuyers earned less than $40,000 annually and 34% earned less than $60,000.

When assessing the likely effect of higher unemployment on potential homebuyers, we believe additional segmentation by age and demographic characteristics is informative. For example, educational attainment and income are less relevant for older cohorts that might be retired, and a job loss clearly impacts a single-income household more so than a dual-income household. Thus, we isolate 20-59 year olds that account for approximately 80% of home purchases, and segment them into four major demographic situations.

In 2018 within the 20-59 year old demographic, married dual-income households accounted for 39% of homebuyers versus married single-income households at 15%. A de minimis 1% of homebuyers were married but considered out of the work force. That leaves 29% in a “non-family” situation, including single buyers or unwed couples without children, and 16% in an “other family” situation, most likely a single person or unwed couple with children. Naturally, the income profiles of these buyers noticeably vary, with only 11% of married dual-income homebuyers earning less than $60,000 versus 44% for non-family and unwed family situations.

As investors and market participants debate how job losses could affect homebuyer demand, we caution against dismissing the potential economic disruption as a low-income or renter problem. Not only has the material increase in unemployment impacted all income levels, but even if upper-income households were eventually spared, our analysis shows that lower-income households are a critical portion of the homebuyer food chain. Undermining this potential entry-level buyer would surely crack the foundation that supports higher price points' ability to sell.

Friday, June 19, 2020 by Zelman & Associates

Filed under: demographicsmacro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey