Home Price Increases Starting to Overcome Low Mortgage Rate Benefit

Wednesday, October 21, 2020 by Zelman & Associates

Filed under: affordabilityhome pricingmacro housingmortgage ratessurvey

Obviously, plunging mortgage rates have done the heavy lifting in this calculus, hitting a new all-time low again last week at 2.81%. However, as we look forward, it is unlikely for the tailwind from cheaper financing to persist. At the same time, homebuilder list prices are surging, with 14% annualized appreciation in September ranking as the most substantial since our proprietary survey data began in 2008. For perspective, prior to 2020, double-digit annualized monthly price appreciation was registered in just eight out of 144 months. In 2020, there have been five such instances, including each of the last four months.

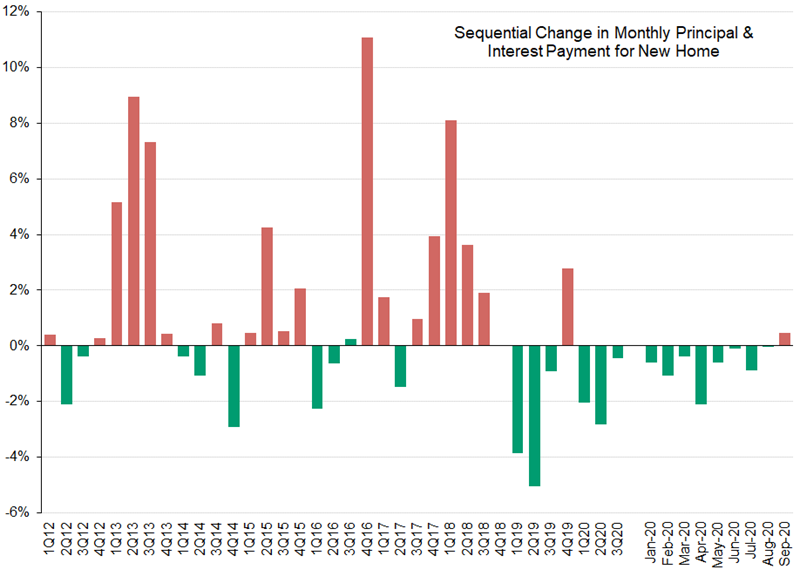

Thankfully for entry-level consumers, the net effect between rising home prices and dropping mortgage rates has been positive for most of this year. Calculated on a monthly basis and adjusted for normal seasonality, the burden of principal and interest improved sequentially each month from January through July. Said differently, the principal and interest payment as of July was 6% lower than December 2019. Although mortgage rates contracted another eight basis points in August and five basis points in September, aggressive price increases are starting to overshadow the benefit. In August, the monthly payment burden was stable and in September it increased for the first time this year, by 0.5%.

With robust consumer demand, limited speculative inventory, rising construction costs and already extended backlogs, homebuilders are in the enviable, yet challenging, situation of unhindered pricing power. The correct economic decision for most homebuilders today is to raise prices. However, this creates the potential for future affordability constraints, particularly if mortgage rates reverse course, even if only marginally. While many assume that Fed policy will result in mortgage rates remaining low for the foreseeable future, we believe the outlook is highly unpredictable, and even small movements in financing costs can matter from such depressed levels.

Since housing unofficially turned the corner in 1Q12, there have been eight quarters when the new home principal and interest burden increased by 3.5% or more: 1Q13-3Q13, 2Q15, 4Q16 and 4Q17-2Q18. Public and private builder new order absorption rates weakened concurrently or shortly thereafter in each case, with the exception of 4Q16. With many centered on the strength of current demand and favorable rates, we are being sure not to overlook price increases that are quickly compounding in the background.

Wednesday, October 21, 2020 by Zelman & Associates

Filed under: affordabilityhome pricingmacro housingmortgage ratessurvey

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey