Which Mortgage Lenders Are Attracting Young Borrowers? You Might Be Surprised

Tuesday, November 10, 2020 by Ivy Zelman, Dennis McGill & Kevin Kaczmarek

Filed under: homeownershipmillennialsmortgagemortgage rates

Some mortgage lenders emphasize the benefit of capturing “customers for life”, whereby they attract younger, often first-time homebuyers as borrowers, retain servicing rights and, ideally, complete one or more future originations from that same borrower. While many lenders tout their technology and online presence as indicative of their appeal to younger borrowers, we have found that lenders that have performed well with this cohort comprise a relatively diverse array of company types and business models.

Looking at the market share of purchase originations to borrowers under the age of 35 in 2019, United Wholesale, Rocket Companies and Wells Fargo topped the list, but each of these appeared near the top of the list for all age groups due to their sheer size. In addition, government loan types such as FHA and VA attract more first-time homebuyers, and not all lenders choose to offer these products. As such, when considering which of the top 25 lenders show an exceptional ability to attract young borrowers, we find it more instructive to measure the share of a particular lender’s loans that are made to sub-35 year old borrowers relative to other ages within each loan type: conventional, FHA and VA.

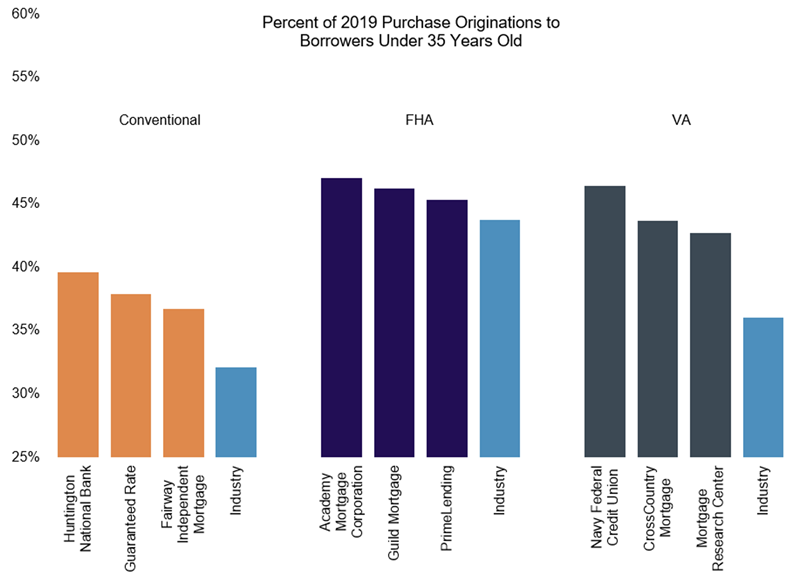

Starting with conventional purchase originations, Huntington National Bank, Guaranteed Rate and Fairway Independent Mortgage had the most exposure to younger borrowers in 2019, with 37-40% of loans going to the under-35 age cohort, well above that of the overall industry at 32%.

For FHA loans, Academy Mortgage, Guild Mortgage and PrimeLending attracted a higher proportion of younger borrowers, with the under-35 crowd garnering 45-47% of these lenders’ purchase originations, modestly higher than the overall industry’s level of 44%.

Finally, looking at VA loans, there appears to be a more dramatic difference in exposure, with Navy Federal, CrossCountry and Mortgage Research Center having 43-46% of their borrowers under the age of 35, versus just 36% for the industry as a whole.

Somewhat surprisingly, these lenders represent a relatively diverse group of company types including banks, credit unions and independent mortgage companies, but they also have different distribution strategies, as some place a greater emphasis on branch networks while others have well-known online presences. Overall, it becomes clear that there is no “one-size-fits-all” strategy for successfully targeting the younger borrower.

Tuesday, November 10, 2020 by Ivy Zelman, Dennis McGill & Kevin Kaczmarek

Filed under: homeownershipmillennialsmortgagemortgage rates

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey