Exploding Housing Demand Viewed in Different Context

Thursday, December 10, 2020 by Dennis McGill

Filed under: existing home salesmacro housingmortgage rates

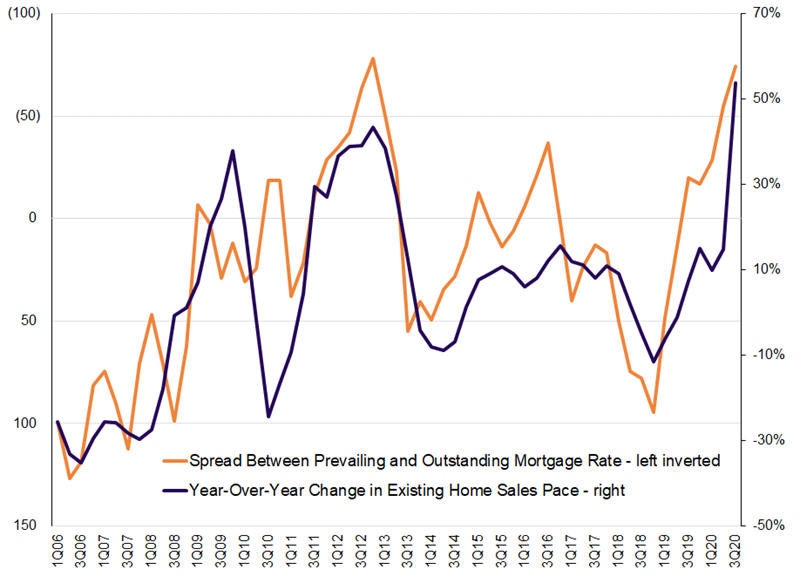

Specifically, in 3Q20, the prevailing mortgage rate averaged 2.95% according to Freddie Mac, down more than 70 basis points year over year and approximately 75 basis points more favorable than outstanding mortgage debt. Dating back to 1990, there have only been 12 other quarters when the comparison was this favorable, the last being in 4Q12.

Importantly, how the prevailing rate has compared to the cost associated with outstanding mortgages has historically proven to be significantly aligned with consumer demand. Not surprisingly, when mortgage rates drop, consumers take advantage through refinancings if they want to stay put, or through purchases if they are a first-time homeowner or seeking an upgrade. For the purposes of this exercise, we quantify demand by calculating the sales pace of existing homes, controlling for available inventory. Since 2005, our demand and interest rate spread measures have been over 90% correlated, with the main outlying period around the implementation and expiration of first-time homebuyer tax credits in 2009 and 2010.

For 3Q20, demand as measured on this basis increased 54% year over year, accelerating from 15% in 2Q20, 10% in 1Q20 and 4% in 2019. In fact, last quarter represented the largest expansion in over 30 years, easily surpassing the prior cycle peak of 43% in 4Q12, which as a reminder, was the last time the interest rate incentive to move was as large as today.

Looking forward from an optimistic angle, if mortgage rates remain depressed as many anticipate, the financial incentive to purchase will persist for at least several more quarters, supporting demand along the way. However, even a modest unexpected increase in mortgage rates can quickly derail the arithmetic. This was the case when the pace of existing home sales growth weakened from 43% in 4Q12 to negative 9% in 2Q14, and from 11% in 4Q17 to negative 12% in 4Q18. Pandemic or not, we expect interest rates to dictate housing demand over the next 12-18 months.

Thursday, December 10, 2020 by Dennis McGill

Filed under: existing home salesmacro housingmortgage rates

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey