Search for Fresh Air Key in 2020, but Not New

Tuesday, January 5, 2021 by Dennis McGill

Filed under: demographics

Given the downward trend of national population growth, we find it most informative to analyze state-level data in relative terms. For example, Nevada’s population expanded by 1.5%, ranking as the third strongest state. However, its growth rate decelerated by almost 45 basis points, the largest for any state, which we attribute to the economic pressure on the travel and gaming sector caused by the pandemic.

Conversely, relative to the near-10 basis point deceleration in national growth, only two states posted acceleration of more than ten basis points – Wyoming (20 basis points) and Montana (19 basis points). We believe outsized growth in these states reflects temporary migration during the initial wave of the pandemic away from dense urban cities to areas of the country where second homes are common.

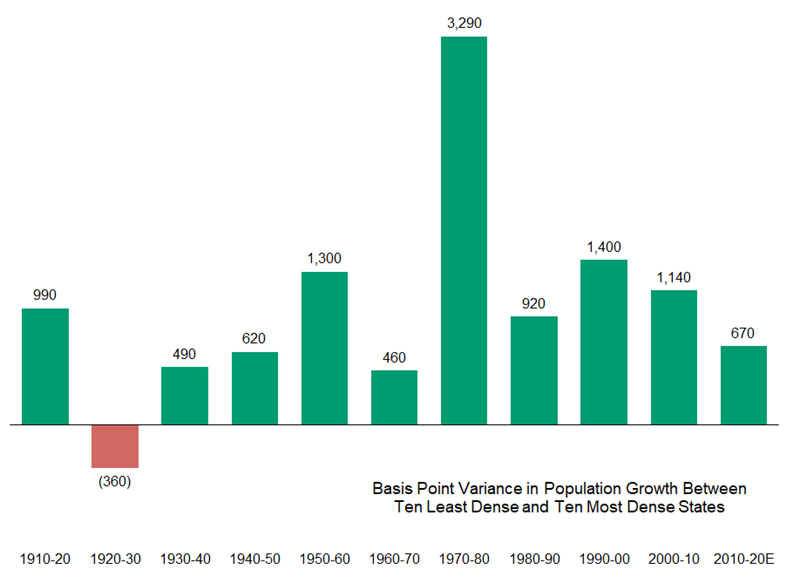

In fact, when ranking states based on their population density per land area, the ten least dense states (including WY and MT) posted population growth of 1.0% in aggregate while the ten most dense states grew just 0.1%. While there is a pandemic story behind those figures, we also note that this trend has been in place for decades.

Over the last ten years, the ten least dense states expanded population by 10.9% while the ten most dense states increased just 4.3%. The 2010-20 timeframe will mark the fifth consecutive decade in which population growth for the most dense states at that time ranked as the weakest quintile. It has not been since the 1920s when the most dense states grew faster than the least dense.

While our country will have to address depressed immigration if it desires to reignite population growth, history suggests that increases, and indirectly incremental housing demand, will continue to be driven by the exurbs of dense metro areas and in less dense states where development can more easily be achieved.

Tuesday, January 5, 2021 by Dennis McGill

Filed under: demographics

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey