A Single-Family Buy-Versus-Rent Comparison Like Never Before

Tuesday, May 25, 2021 by Dennis McGill & Alan Ratner

Filed under: affordabilitybuild-for-rentnew home salessingle-family rental

Over the last two years, five public homebuilders in our coverage universe have formally announced plans to expand into the rapidly-growing single-family build-for-rent market. It is likely in the quarters ahead that others follow suit as multiple billions of dollars across many different types of investors are chasing this evolving concept. While operating strategies thus far vary, directly comparable product is becoming more common.

Last week, D.R. Horton announced that its single-family rental arm, DHI Residential, will be opening its first rental community in the Orlando area. Avian Pointe in Apopka will feature a mix of roughly 300 single-story detached homes and townhomes, ranging in size from 1,567 to 2,601 square feet. Leveraging our proprietary database of all active public homebuilder communities, we can uniquely compare both the type and cost of rental product in Avian Pointe to competing for-sale product in the immediate vicinity.

Among our public homebuilder coverage universe, there are eight actively-selling communities located within five miles of Avian Pointe, including three built by D.R. Horton. On average, the for-sale product located in these communities has four bedrooms and three bathrooms, similar to the average of four beds and 2.5 baths in DHI’s rental community. The sizes of the for-sale homes range from approximately 1,400-4,440 square feet. Although the average size of the for-sale homes in these communities (2,485) is nearly 30% larger than the rental product average (1,940), there is ample overlap of similarly-sized product for consumers deciding between owning and renting. Specifically, approximately 60% of the floorplans offered in the eight competitive for-sale communities are sized within the square footage range offered at Avian Pointe.

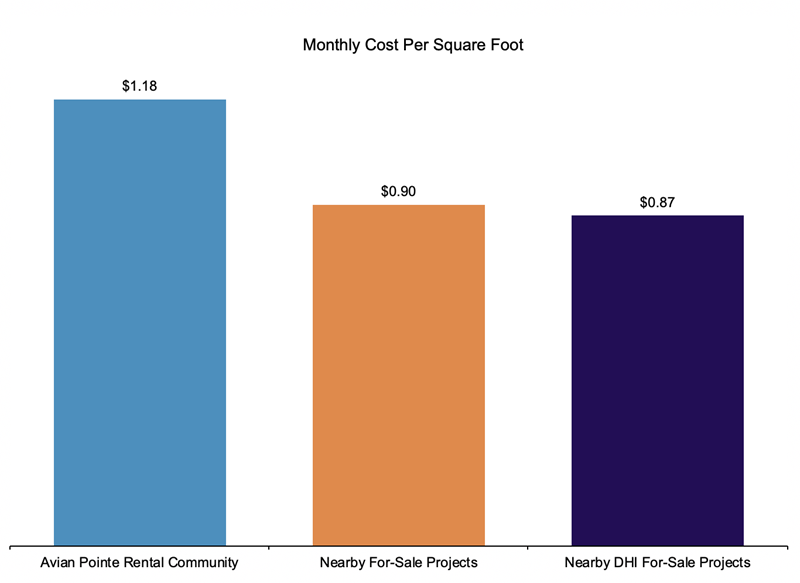

On the cost side, the average price of homes in the for-sale communities is approximately $390,000, including an average price of $370,000 in D.R. Horton’s three communities. Assuming an FHA loan with a 3.5% down payment, annual mortgage insurance and property taxes, this would amount to a monthly payment of $2,160. For comparison, the average monthly rent in Avian Pointe is 4% higher at $2,250 despite the rental homes being significantly smaller. On a per-square-foot basis, it will cost $1.18 per month, on average, to rent in Avian Pointe, more than 30% higher than the average cost of ownership of $0.90 per month across all of the for-sale communities in our analysis.

Notably, while we believe this comparison offers the most accurate buy-versus-rent analysis to date, there are still caveats to highlight. In calculating cost of ownership, we assume base pricing on for-sale product. In reality, we know consumers often spend as much as 10% of the price of a home on options and upgrades. On the other hand, we are not incorporating any benefit of ownership including tax deductions or the accumulation of equity.

Clearly, there is robust demand across the entire single-family residential asset class right now and a dearth of both for-sale and for-rent inventory. However, with more supply poised to come to the market in the quarters ahead and a flood of capital chasing single-family rental, it remains to be seen whether the type of price premium being sought by communities such as Avian Pointe can be sustained.

Tuesday, May 25, 2021 by Dennis McGill & Alan Ratner

Filed under: affordabilitybuild-for-rentnew home salessingle-family rental

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey