Built-For-Rent Participants Targeting More Tertiary Markets

Tuesday, November 30, 2021 by Kevin Kaczmarek & Jesse Lederman

Filed under: build-for-renthome pricing

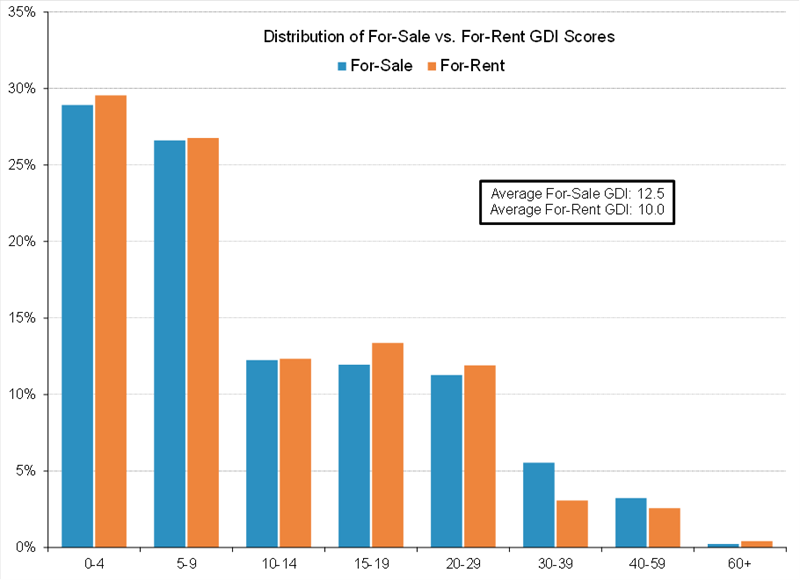

One of the nuances analyzed in our report was the location of these deals and how they compared to markets targeted by traditional for-sale homebuilders. Utilizing our proprietary Geo Descriptor Index (GDI), which ranks locations on a 0-100 scale, from extremely suburban (0) to extremely urban (100), it is clear that built-for-rent operators and investors have been targeting more suburban locations over the last couple years. Specifically, new homes constructed by for-sale homebuilders had an average GDI of 12.5, while communities purpose-built for-rent had an average GDI of 10.0, indicating a more suburban concentration. Further, more than 55% are located within zero to nine on our index, 80 basis points greater than for traditional for-sale communities.

There is also an important affordability component underlying the desire to target more tertiary markets. Theoretically, moving further into lower-GDI markets, where land is more affordable, should translate to cheaper monthly rental payments, all else equal. In an effort to quantify the difference in land prices between locations based upon their GDI ranking, we analyzed land values associated with single-family residences across more than 8,000 zip codes in recent years and found the median value per acre in zip codes with GDIs under five stood about 40% below those in zip codes with GDIs between five and ten.

That said, while cheaper land costs may lower the initial land investment, it does come with greater uncertainty regarding longer-term rental demand trends should consumers’ interests in these further-out locations subside quicker and more meaningfully than in core markets once demand begins to wane.

Despite this move to lower GDI areas, built-for-rent product does not screen as a particularly affordable option based on a case study we conducted, which compared the monthly payments associated with these built-for-rent communities and nearby single-family for-sale and traditional multi-family apartments. In fact, across our sample, built-for-rent homes were priced 12% higher, on average, than nearby comparable product.

Notably, nearly 80% of the $75 billion of capital raised to date targeting built-for-rent development has yet to be deployed; however, once it is, we believe a continued push into tertiary markets is needed to make pro-forma underwriting pencil given the backdrop of rapid lot price inflation, which has reached upwards of 30% in some markets across the country. While pricing differences between communities will always persist given market-specific factors such as quality of schools and crime rates, the incremental for-rent supply married with a significant ramp in for-sale production could pressure lease-up rates relative to optimistic underwriting assumptions.

Tuesday, November 30, 2021 by Kevin Kaczmarek & Jesse Lederman

Filed under: build-for-renthome pricing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey