Will Media Narrative Surrounding Homeownership Declines Embolden Already-Aggressive Built-for-Rent Developers?

Thursday, November 18, 2021 by Alan Ratner

Filed under: build-for-renthomeownershipmacro housingmillennialssingle-family rental

The narrative is a convenient one, especially considering the enormous wall of capital that has been raised and is looking for investment opportunities in the built-for-rent (BFR) space. However, is it rooted in fact or hyperbole?

Two weeks ago, the Census Bureau released the 3Q21 Housing Vacancy and Homeownership Survey, which revealed a 20 basis point sequential decline in the seasonally-adjusted national homeownership rate to 65.4%. On a year-over-year basis, the 200 basis point decline more definitively tells the story of young adults spurning the dream of homeownership for the flexibility of renting.

Analyzing the data on a two-year basis, which eliminates the elevated sample error from last year’s survey conducted during the depths of the pandemic, homeownership rates have increased for all major age cohorts younger than 40 over the last two years, led by a 220 basis point increase for 35-39 year olds. We believe this smoothed analysis more clearly tells the story of a gradually rising demand for homeownership that was well underway prior to the pandemic.

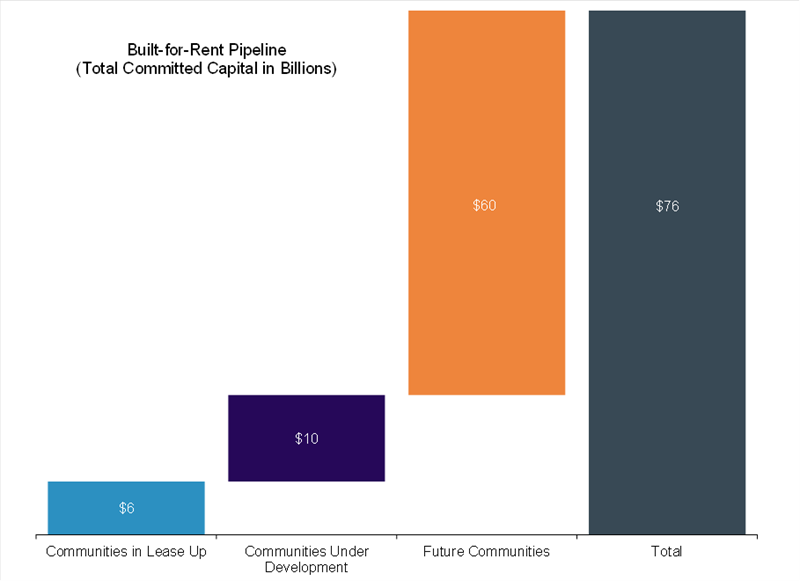

Meanwhile, the optimism in the BFR space continues undeterred. In September, we published a proprietary deep-dive analysis of the swelling pipeline of BFR investments and projects. At the time, we identified more than $60 billion of capital across roughly 60 unique ventures that had been raised or committed to targeting BFR. Since then, another $13 billion of capital has been committed to the BFR space, bringing the total pipeline to $76 billion and growing.

Interestingly, while capital continues to flock to BFR, at least one well-established player in the space appears to be opportunistically taking some chips off the table. NexMetro Communities, a BFR developer founded in 2012 with more than 7,000 homes currently completed or under development, sold an 89-unit project in Phoenix this month for $37.2 million. The per-unit price of $418,000 is more than double the $200,000 per-unit price it achieved on its first Phoenix community sale in June 2018.

While these two projects are located roughly 20 minutes apart, rental rates are similar between the two communities, providing a decent comparable. For reference, the approximate 110% increase in per-unit sales price achieved by NexMetro over a three-and-a-half year time frame compares to a 58% increase in Phoenix home prices over this same period, according to Core Logic – demonstrating the current exuberance in the built-for-rent space.

Thursday, November 18, 2021 by Alan Ratner

Filed under: build-for-renthomeownershipmacro housingmillennialssingle-family rental

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey