High-End Housing in Focus as Loan Limits Rise

Monday, December 6, 2021 by Kevin Kaczmarek & Ryan McKeveny

Filed under: existing home saleshome pricinghomeownershipreal estate services

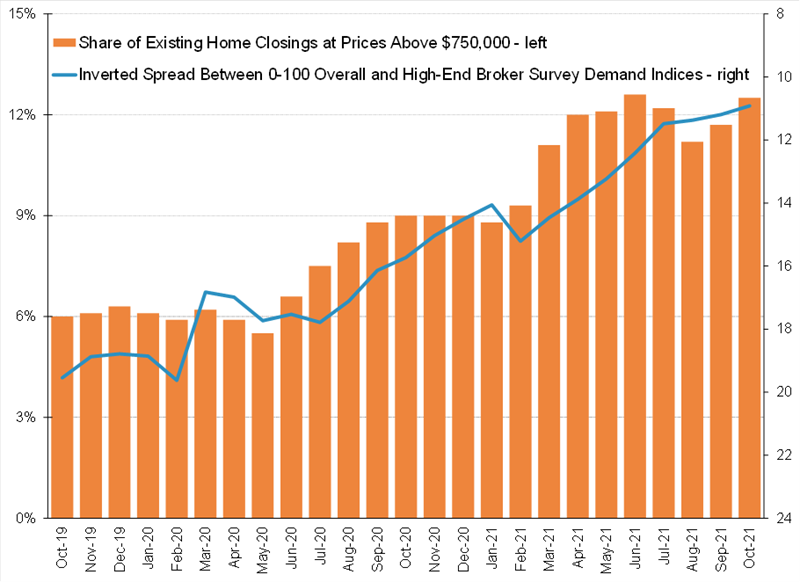

Leveraging our Real Estate Broker Survey, high-end outperformance began last summer and has accelerated through 2021. In fact, the spread between our overall homebuyer demand rating and our high-end demand rating narrowed to its lowest level in our most recent survey, a signal of comparative strength continuing in the upper price points. Framed differently, our overall demand rating has been lower on a year-over-year basis for the past four months versus difficult comparisons, whereas the high-end demand rating has continued to expand slightly.

Our survey results are supported by data from the National Association of Realtors, with overall existing home closings declining year over year since August, but home closings at prices north of $750,000 still growing approximately 30% over this timeframe. As of October, the share of existing home closings at prices above $750,000 equaled 13%, compared to 9% a year ago and just 6% in October 2019 and October 2018. Similarly, the share of closings above $1 million equaled 7% this October versus 5% in October 2020 and 3% in October 2018-19.

To be sure, the surge in home prices over the last 18 months has shifted the entire sales spectrum higher, with Case-Shiller “tier data” highlighting average year-over-year home price growth of 17-19% over the last six months across the high, mid and low tiers. That said, even after accounting for mix-related benefits, it is still the case that the higher-end segment has slightly taken share year over year, and has expanded significantly versus pre-pandemic trends.

Specific to loan limit increases, the media and some politicians have honed in on the small subset of the highest-cost markets seeing GSE loan limits rise to $970,800, fueling rhetoric around the nature of government support for housing. Of note, across all markets designated as “high cost,” 55% of purchase originations were in markets where GSE loan limits are increasing at a slowerpace than home price appreciation over the last year, effectively contracting government support within those locations including Boston, Denver, San Diego and Seattle. On the other hand, 45% of originations in high-cost markets occurred in areas that will see loan limits expand by more than the rate of local-market home price growth, including metro New York and San Francisco, implying incremental government support in these select areas.

Overall, since the pandemic began, catalysts to high-end strength have included compelling mortgage rates, the desire for larger homes, mobility of luxury consumers out of high-cost urban centers into their suburban counterparts, the wealth-effect of a rising stock market and diversification into real estate amongst high net worth individuals – including second homes. Though underlying strength remains apparent for now, we would expect moderation in 2022 as a portion of discretionary activity was pulled ahead – regardless of changes to loan limits – which is included in our expectation for a low-to-mid single digit decline in existing home closings versus 2021.

Monday, December 6, 2021 by Kevin Kaczmarek & Ryan McKeveny

Filed under: existing home saleshome pricinghomeownershipreal estate services

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey