Advertising Expense Across Homebuilding Industry Plunges; A Secular Shift or Cyclical Benefit?

Wednesday, March 16, 2022 by Alan Ratner

Filed under: homebuildinghousingnew home salessg&a

For all the discussion and debate about whether the industry has made operational improvements to structurally increase “normalized” gross margins on a go-forward basis, the remarkable improvement in SG&A leverage over the course of this cycle has garnered relatively less attention. Many companies have highlighted technological investments that have contributed to reduced reliance on brokers and traditional print advertising spend, but it is difficult to separate out the long-term benefits of digital marketing from the cyclical advantages of one of the strongest housing markets ever seen.

With public homebuilders having recently filed 10-K annual reports for 2021, we drilled in deeper to one component of the companies’ SG&A expenses that has declined meaningfully of late – advertising expenses. Among our coverage universe of 15 publically-traded homebuilders, ten disclose annual advertising expenses. This subset of companies spent $295 million on advertising in 2021, down 3% from 2020 and 19% from 2019.

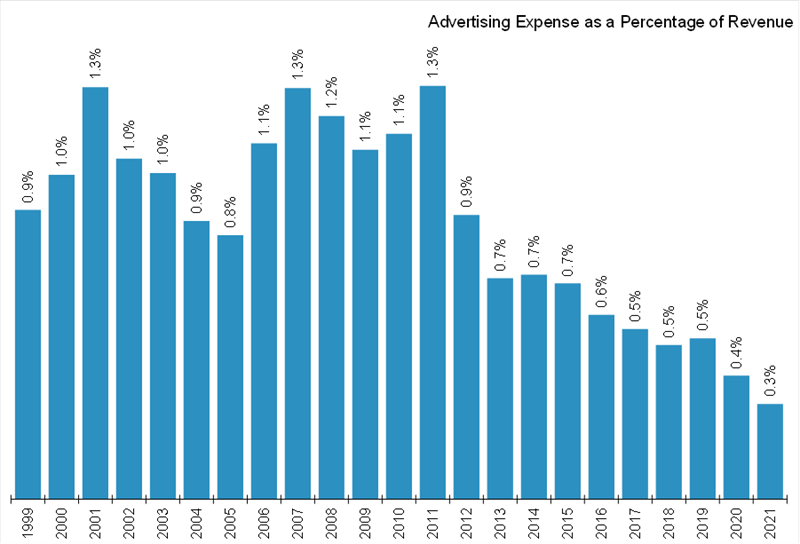

The decline is even more impressive considering 16% compounded annual growth in revenue over this two-year period. As a result, advertising expense equaled just 0.3% of revenue in 2021, down from 0.4% in 2020 and an average of 0.6% from 2012-19. On a dollar basis, these homebuilders spent just $1,210 on advertising per closing in 2021, down from $1,460 in 2020 and an average of $2,130 from 2012-19. Even back in 2005, advertising dollars per closing equaled $2,210.

Clearly, significant advertising efforts are not necessary in today’s robust demand environment – especially considering how tight inventories are across both the new and resale markets. Still, it is apparent that there have been very tangible structural improvements made in this area of the business considering advertising expenses were already trending well below prior boom-period levels before the pandemic started.

If we eventually see demand negatively impacted by higher rates, slower economic growth or other factors, it seems fairly intuitive that homebuilders will spend more on advertising to draw potential buyers to their communities. That said, even during prior periods of softer demand this cycle, including the rate-shock period in 2018, advertising expense remained well below prior periods. Thus, we suspect this is one area of the homebuilding business that has seen real, secular changes over the last decade and believe digital marketing efficiencies should contribute to roughly 50 basis points of sustainable SG&A leverage compared to long-term historical averages.

Wednesday, March 16, 2022 by Alan Ratner

Filed under: homebuildinghousingnew home salessg&a

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey