With Cash-Outs Now Dominating Refinances, Which Lenders Are Best Positioned?

Thursday, May 19, 2022 by Kevin Kaczmarek

Filed under: mortgagemortgage rates

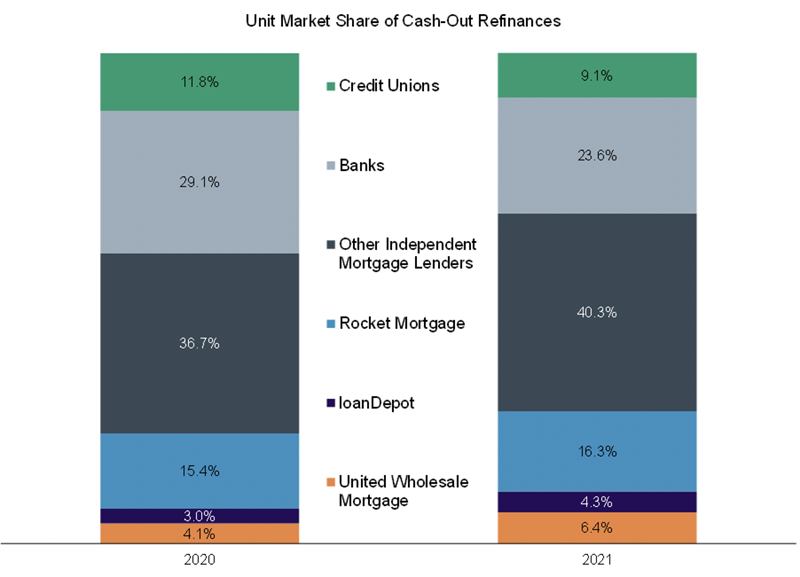

With that background, which lenders gained the most market share in cash-out refinances last year? According to HMDA data, United Wholesale was the largest market share gainer in terms of unit volumes, increasing share by 230 basis points to 6.4%, the second highest in the industry. UWM’s gains were most notable amongst borrowers under the age of 35 and, in terms of geography, borrowers in CA, FL and AZ. Three other notable share gainers include Wells Fargo (130 basis points to 2.4%), loanDepot (130 basis points to 4.3%) and Rocket Mortgage (90 basis points 16.3%) which built on its already dominant position.

On the other end of the spectrum, which lenders lost share? At a high level, although Wells Fargo clearly bucked the trend, banks took a back seat in the cash-out origination market. Overall, banks originated just 23.6% of all cash-out refinances in 2021, down 550 basis points from 2020 after holding share between 29.1% and 30.9% in each of the three previous years.

Looking to 2022, although higher rates have pressured both types of refinances, rate-lock data from Optimal Blue indicates rate-term refinance volumes through April are down over 80% versus the prior-year period, while cash-out refinances are only about 15% lower. With lenders across the industry struggling with both significant volume and margin pressure, those companies that were able to gain share in the less-volatile cash-out market have likely placed themselves in a better position to weather the current storm.

Thursday, May 19, 2022 by Kevin Kaczmarek

Filed under: mortgagemortgage rates

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey