FHA Borrowers Cry "Uncle" for Downpayment Help

Thursday, August 25, 2022 by Kevin Kaczmarek

Filed under: affordabilityentry-levelmortgage

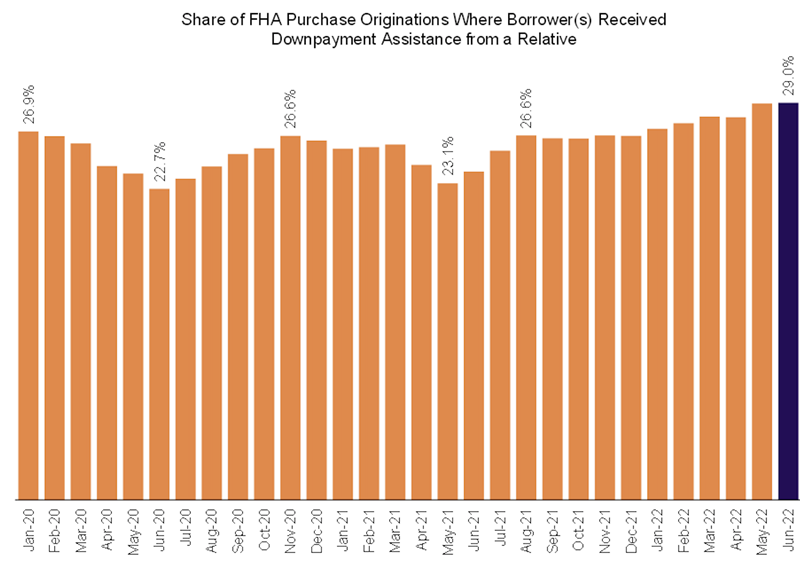

As such, for many entry-level borrowers, while the 3.5% downpayment required by FHA mortgages is relatively low when compared to the typical downpayment for a GSE-backed or jumbo mortgage, the current environment has caused a record share of homebuyers using FHA mortgages to turn to family for help with downpayments. More specifically, in June, 29% of homebuyers using FHA mortgages received downpayment assistance from relatives, up 500 basis points year over year, marking the highest monthly share in the last seven years and the third-highest in at least the last 12 years. Looking at regional trends, some of the largest markets that led the year-over-year increase include Chicago, Los Angeles, Orlando and Phoenix.

While today’s home price appreciation and inflation levels far outpace anything seen over the past 12 years, the use of family proceeds generally appears to increase when mortgage rates rise, as they have recently. In fact, since 2010, the year-over-year change in the 30-year Freddie Mac mortgage rate has shown a 0.67 correlation to the change in the share of FHA purchase originations using downpayment assistance from relatives. Given this and the aforementioned macro issues, barring a meaningful decline in rates or broad-based change in lenders’ underwriting practices, FHA borrowers’ dependence on relatives appears unlikely to significantly decline in the near-term.

Thursday, August 25, 2022 by Kevin Kaczmarek

Filed under: affordabilityentry-levelmortgage

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey