Are Home Prices Being Viewed With Rose Colored Glasses?

Wednesday, November 2, 2022 by Ryan McKeveny

Filed under: affordabilityhome pricing

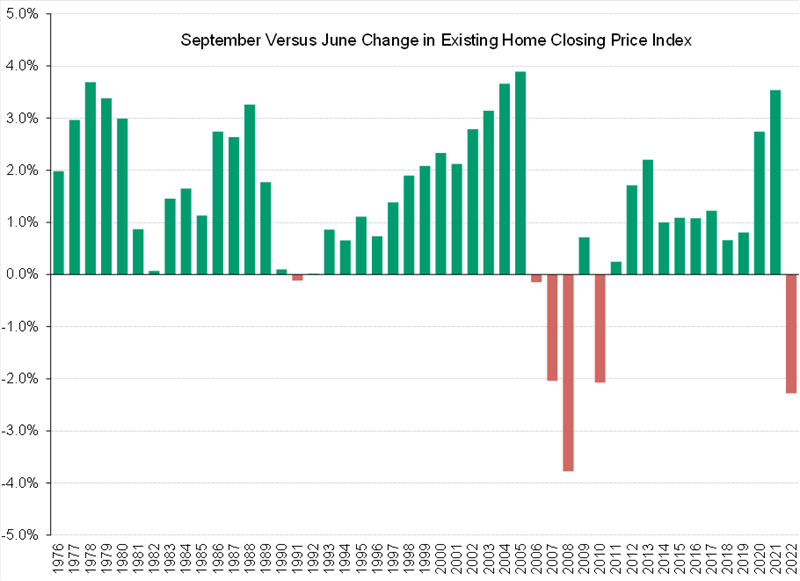

Aligning with the typical adjustments to CoreLogic’s preliminary data releases, we estimate that September’s decline will likely be revised closer to an 80 basis point decrease, with both July and August already having been reduced by a similar magnitude. Including this assumed revision for September, national home prices, based on CoreLogic’s index, would be down 2.3% from the peak in June, roughly tracking with our expectation for a 5.0% decline in home prices from June through year-end.

Notably, with CoreLogic data available since 1976, the current period would rank as the second steepest pullback in home prices from June through September over this timeframe, trailing only 2008, which was down 3.8%. As further historical context, when analyzing past periods of pricing pressure, after home prices initially declined for three consecutive months in 1990, they continued to sequentially decrease in 10 of the next 15 months. Naturally, the Great Financial Crisis was more dire, with home prices declining in 50 of the 67 months following the initial three-month downtrend.

While the impact of higher mortgage rates on home sales activity has been very visible – with the NAR’s pending and existing home sales data at its lowest levels since 2010 and 2012, respectively – it seems that many economists and housing forecasters may be wearing rose colored glasses when considering future home price risk. CoreLogic forecasts 3.9% home price growth from September 2022 through September 2023; the 3Q22 Zillow/Pulsenomics survey of over 100 “economists and housing experts” points to an average expectation of 2.6% home price appreciation in 2023 on a year-end basis; Freddie Mac expects a modest 0.2% decline on a full-year average basis in 2023; and Fannie Mae now models just a 1.5% decline in 4Q23 versus 4Q22.

Following our expectation of 5% home price deflation from the peak in June through year-end 2022, we expect home prices to decline an additional 5% by the end of next year, or 4% on a full-year average basis for 2023. Overall, we view the recent pullback in home prices as the start of a trend as opposed to a blip in the data, and absent a sharp reversal in mortgage rates, we would expect the consensus outlook for home prices to grow incrementally more negative from here.

Wednesday, November 2, 2022 by Ryan McKeveny

Filed under: affordabilityhome pricing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey